Note: I will be on CNBC’s The Exchange Monday at 1:40PM ET to talk with anchor Kelly Evans about the chances for a near-term resolution of the trade war and its impact on markets. And I will post a longer piece tomorrow about the briefing on the topic I gave at the White house last week.

Who could have guessed that a trade war would damage the companies that engage in international trade?

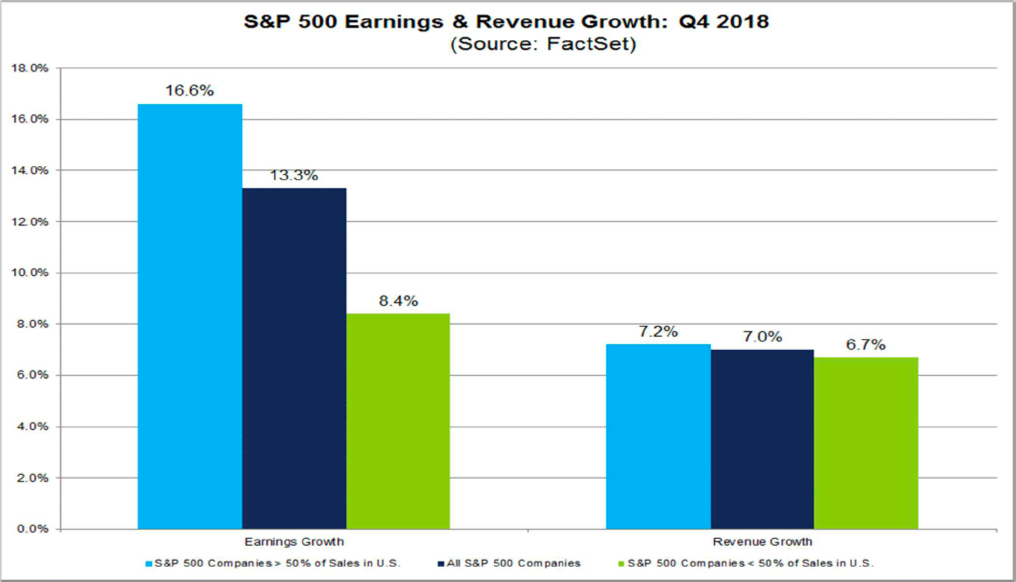

With two-thirds of the companies in the S&P 500 having reported Q4 earnings, it is easy to see the damage done by the trade war. S&P 500 companies collect 63% of their revenues from domestic sales and the remaining 37% of sales outside the US. As the chart below shows, the companies in the index that generate more than half of their sales abroad had slightly lower revenue growth but only half the earnings grew of companies with mostly-domestic revenues.

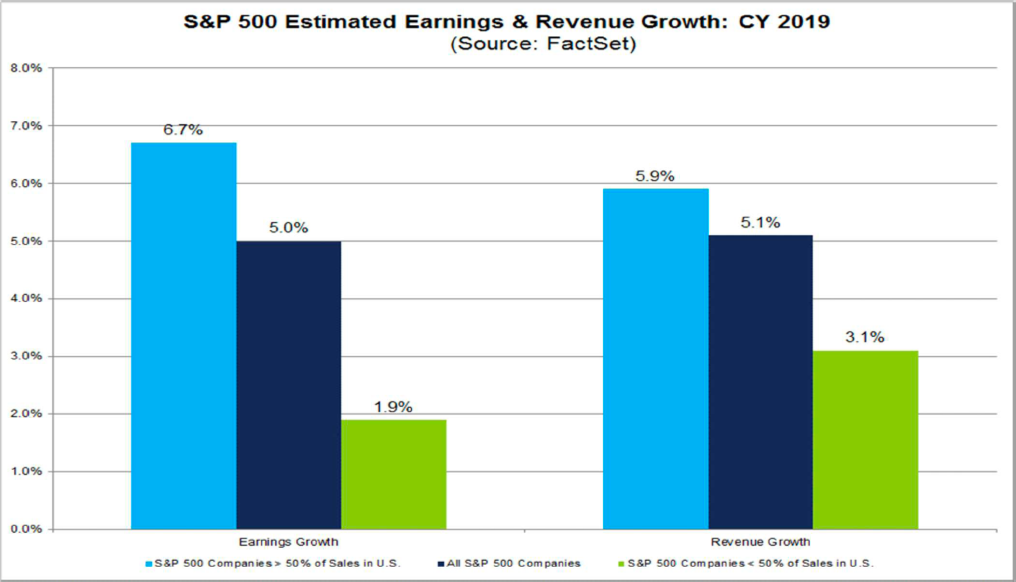

Analysts expect it to get worse in calendar year 2019. Overall revenue and earnings growth will shrink significantly from Q4 levels. Firms with large foreign revenue exposure will see revenue growth of (3.1%) and earnings growth of (1.9%), much lower than mostly-domestic firms.

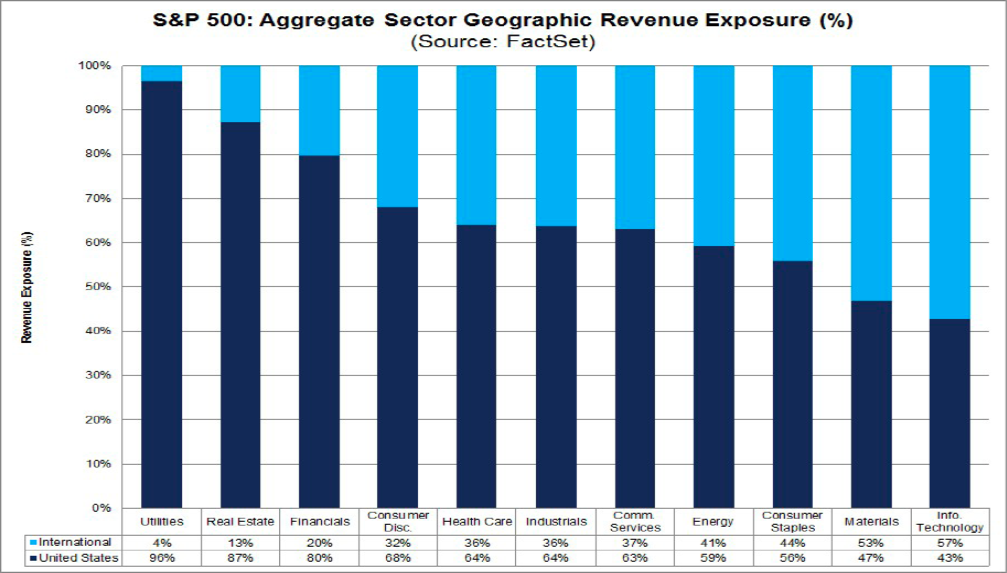

The chart below shows the significant difference in relative exposure of the different sectors in the S&P 500.

All in all, I still have a strong taste for Treasury bills until I see reliable evidence that the global trade situation is improving.

JR