Summary: On Friday I talked with my friend and CNBC Power Lunch anchor, Tyler Mathisen, about the US/China trade talks scheduled to take place over the weekend that have now been postponed–indefinitely. You can see a brief video of the conversation by clicking here. I have also posted the (unedited) talking points that I wrote to brief Tyler ahead of the show to let him know what’s on my mind. I hope that you enjoy.

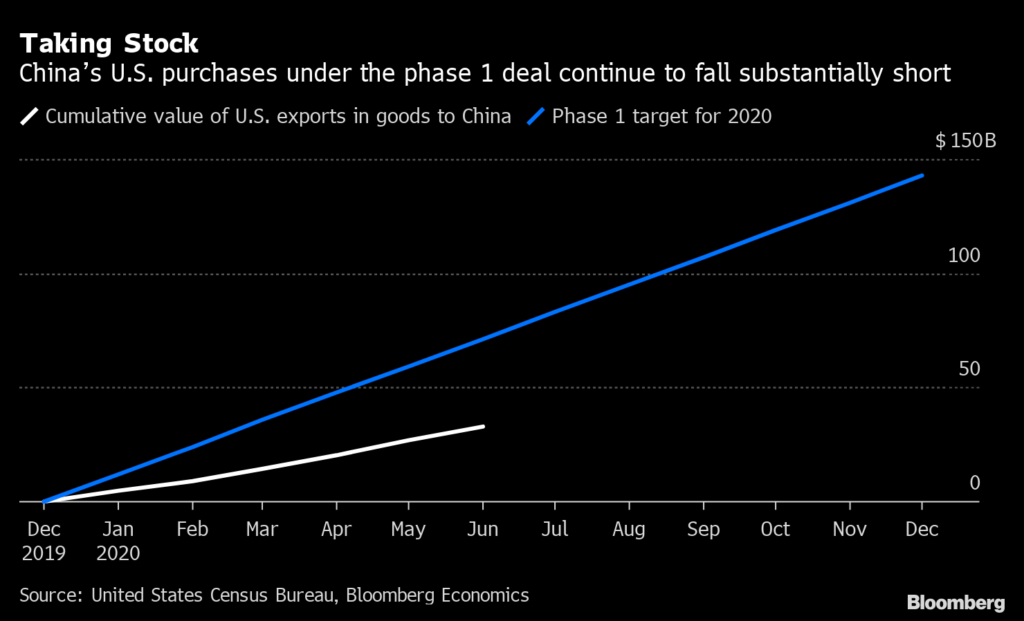

1. Resumption of trade talks. Getting China to agree to purchasing targets for soybeans and other items is easy; enforcing it is hard. To date, China has bought less than half what they promised in the Phase 1 deal (chart below). But maritime data show they have been big soybean buyers from Brazil. Both sides know that this is a huge election item for Trump in November. It will be a big part of discussions if talks are held.

There is no reason for China to give up anything of real value with the elections so near. At this point, the talks are largely political theater for both governments. Politically, I would advise the White House to have the talks, to announce that we twisted their arm into buying more stuff from swing states, and to make a list of tough-sounding actions they can announce over the next two months. The Chinese press, of course, would report the meetings as a great success for China but nobody here will report that because, except for a few weirdos like me, Americans haven’t invested the time to learn to read Mandarin.

2. Tech trade war. Huawei/ZTE are perfect targets for the China haters in the White House. The US has had some recent success getting other countries, most notably the UK, to kick them out. But the little countries that form most of Huawei’s systems market (and Xi’s Belt/Road mission) have largely decided they can no longer afford to only be a client of the US. They will continue to use Chinese 5G infrastructure. Banning US designed microchips would be a dangerous move, as they are largely made in Taiwan.

3. Election/Politics/Cold War. China hating is Trump’s most effective election theme. We are all tribal in our genes; tribal chest thumping will rise to high levels as we approach the November elections. Democrats have piled on too but, so far, the best they have is “we hate China too”. This issue is a winner for Trump. We will hear more about it every day from the White House.

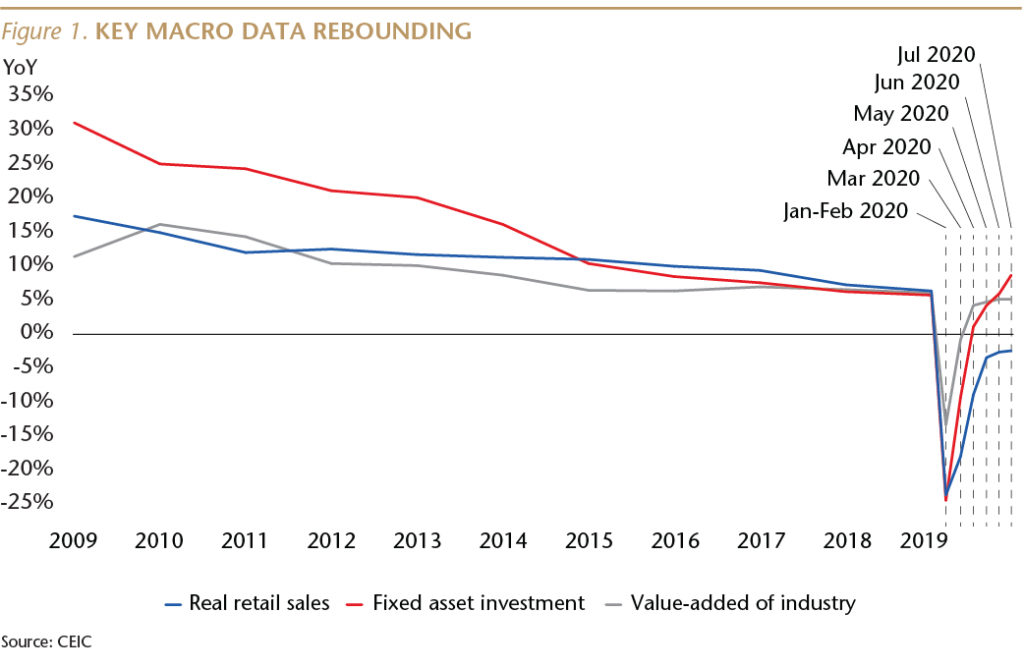

4. China’s power increasing relative to the US. It is clear that the countries that clamped down hard on COVID are the ones that are now rebounding the strongest. (This week Malaysia reported it is coming back strong, while the Philippines is not). This includes China as you can see in the chart, below (courtesy of Andy Rothman, who understands Chinese data better than anyone I know). The relentless increase in the relative size of the China economy compared with the US is a surrogate for the overall balance of global power. Not good for us.

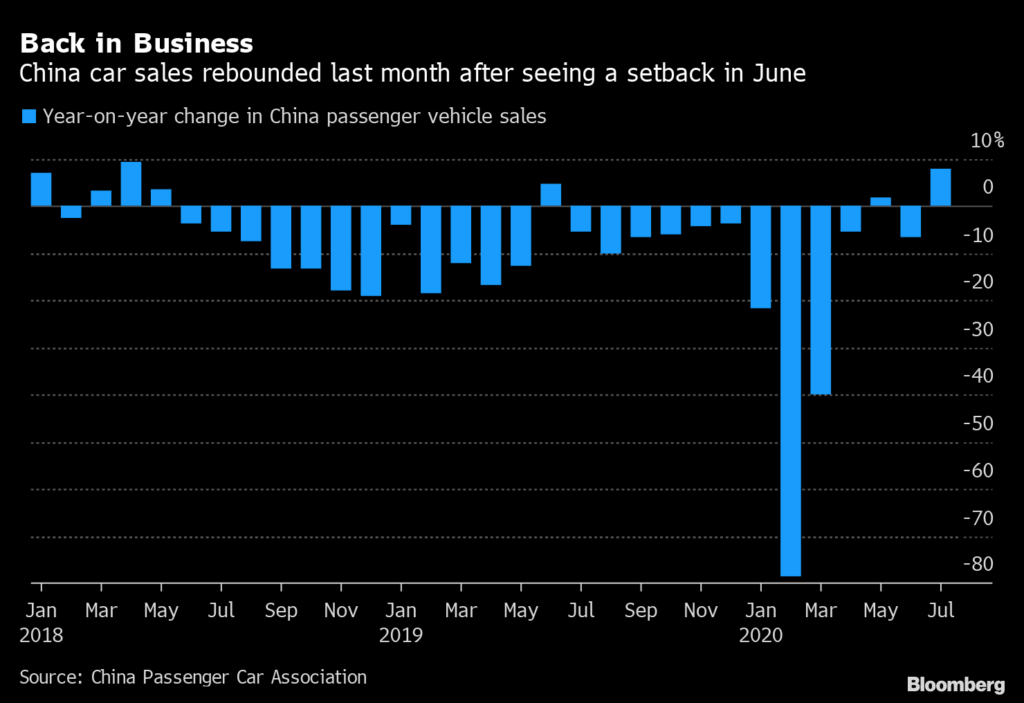

China bashing here has actually reinforced this by forcing China to focus on domestic consumer growth. (See the auto sales charts below)

5. Tougher news on the economy ahead. I believe we are in for a difficult time this fall, both for the economy and the stock market. Increased unemployment benefits and a downpour of $1200 checks actually made disposable income GO UP in Q2, so people have been buying lots of stuff from Amazon. For their part, the Fed and Treasury have driven mortgage rates down, which has temporarily supported home prices. But the checks won’t last forever and the forbearance measures in the CARES Act that have allowed both consumers and lenders to dress up their balance sheets will end. When that happens, I believe credit markets will seize up. That is likely to end this later this year, as I will explain in my next post.

6. So what’s a bear, or an investor, to do? Here’s what I am doing with my personal portfolio.

- Stocks vs cash. I have been selling stocks in recent weeks, down to 50% (50% stocks) cash today and will be 70% cash by the end of August. (Started with 70% cash in February, I only bought ‘Robinson Crusoe’ stocks (only the ones you would own if you knew you were going to be stranded on a deserted island for 50 years) during Q2.

- Tech vs BDUs. I have been selling the big name tech stocks in recent weeks—AMZN, AAPL, MSFT, BABA–because their prices have been driven to absurd levels. I will buy them back later.

- The Huawei thing. I own some ERIC and NOK and am buying more. 5G is a very big deal for every country in the world that wants to grow. If the US succeeds in pressuring other countries into rejecting Huawei equipment they will need to buy it from Ericsson or Nokia, the only other game in town.

- China stocks. “America hates China’ says sell Chinese stocks. China’s strong domestic growth says to buy them. The two I own and like are BABA and TCEHY (Tencent). Together, they dominate the mobile payments business in China. Tencent is dodgy since they are in the eye of the TikTok hurricane so only buy it at a big discount to BABA.

JR

Sorry for being obtuse. bDU stands for Big, Dumb, and Ugly, a 1980s term for the old heavy smokestack industries that used to dominate the market. Think of it as a reference to value stocks, as posed to growth stocks.

Can anyone tell me what a BDU is?

(–from topic 6. “Tech vs BDUs. I have been selling the big name tech stocks in recent weeks. . . )