Summary: Economic forecasts for 81 countries show that all major areas of the world will grow in 2019. Unfortunately, an analysis of more than 100,000 forecasts of GDP over 20 years shows that economic forecasters are never able to predict a downturn until after it happens. There is a reason for this.

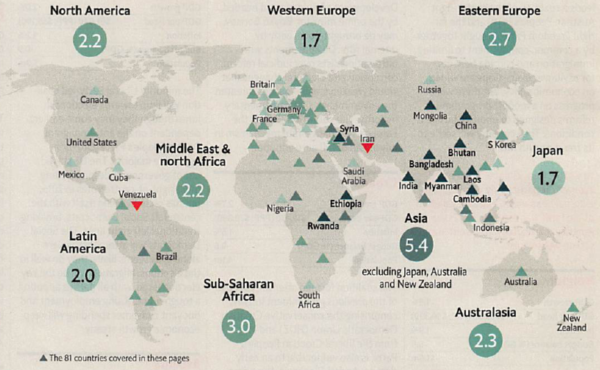

Great news! A survey of the economies of 81 countries conducted by The Economist magazine shows that all major areas of the world will show positive growth in 2019, as shown in the chart below.

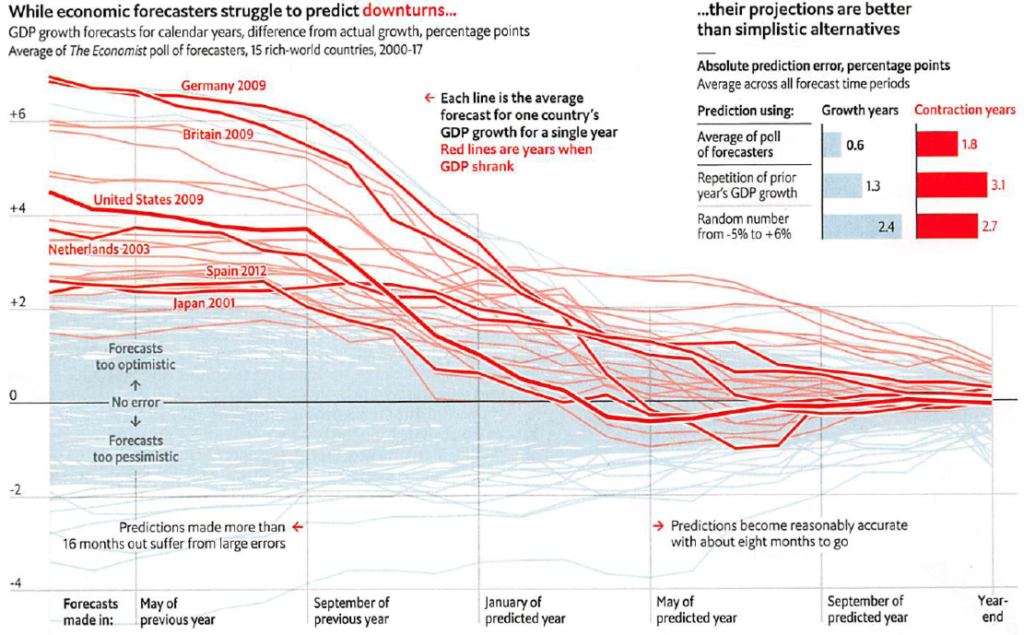

Not so great news. As shown in the chart below, an analysis of more than 100,000 forecasts of GDP for 15 rich countries over 20 years, conducted by the same magazine, shows that economic forecasters have no ability to predict a downturn until it has already happened. Bummer.

A closer look at the chart shows that there are really two sets of results. The light blue lines, clustering around zero (no error) are all taken from years where GDP growth was positive. The red lines–the really embarrassing ones–are all taken from years where GDP growth was less than zero. These two sets of results represent two different qualitative states for the economies, one where they are working as market economies are supposed to work, the other where something is broken. Economists understand the first one because it represents the concept of equilibrium. They do not understand the second one because their so-called general equilibrium models rule it out by assumption.

As I tell my PhD students, the first equilibrium state represents the market economy described by Friedrich von Hayek in his classic 1939 and 1944 articles (the first two papers I have them read) on the role of knowledge in the economy. Market economies, wrote Hayek, are actually decentralized communications network that transmit information about relative wants and scarcities to just the people who need it using signals we call prices. When the communications network is working well, markets are efficient and the economy runs at or near full capacity. In this situation, GDP will grow at the rate implied by the growth of its capital, labor, and other resources and is relatively easy to predict.

The second far-from-equilibrium state represents a situation where the communications network has suffered a temporary partial or total collapse, like an electricity grid after a major storm, and people can no longer rely on prices for the information they need to make decisions. Historically, these cascading network failures have taken place in asset markets, rather than product markets. We call them financial crises. Hundreds of examples have been catalogued, including the subprime mortgage crisis that we have been climbing out of for the past decade.

When von Hayek first wrote about economies as information networks, network theory was in its infancy–he actually invented the concept of a neural network himself as a young man. But now, thousands of papers have been written about networks in biology, chemistry, physics, ecology, and even economics. It turns out that financial crises exhibit statistical behavior that is very similar to the phase transitions between states we know as volcanic eruptions, earthquakes, avalanches, tsunamis, hurricanes, and ecological collapse. Like their physical counterparts, they are natural and unavoidable. And they are just as hard to predict, which is why we should not expect much from economic forecasts at this point.

There is feverish work going on trying to identify the statistical markets of an impending phase transition. You can learn more about them by clicking here and downloading the syllabus for my course in far-from-equilibrium economics. Early results point to sudden spikes in variability, autocorrelation, and a phenomenon called slowing of time, where systems disturbed from equilibrium require more calendar time to return to normal. More on this in later posts.

JR