Summary: Event risk (Mueller-risk in the US, Brexit in the UK and Germany, the trade war and credit crunch in China) is so high today that it is almost impossible for a prudent investor to commit capital into the future. This has undermined capital spending everywhere. It has also created opportunities. I like the case for long-term investments in the UK once the Brexit fog has lifted.

Long ago we decided it would be an adventure to move to the mountains. So, we sold the station wagon (if you are too young to know what that it, it was kind of a flat SUV), bought a Subaru with a stick shift, and moved into a wonderful house on the shore of Lake Arrowhead. All went according to plan until the first time I tried to drive down the mountain in heavy fog. I was scared to death.

The road is called Rim of the World Drive, and for good reason. If you stray off the edge it is a straight 4000 foot drop to San Bernardino. But you couldn’t see the front of your hood, much less the edge of the road. So, the trick get in the middle of the road, open the driver-side door, and look straight down. As long as you could see the white line under your door you were OK. And don’t go faster than you can walk.

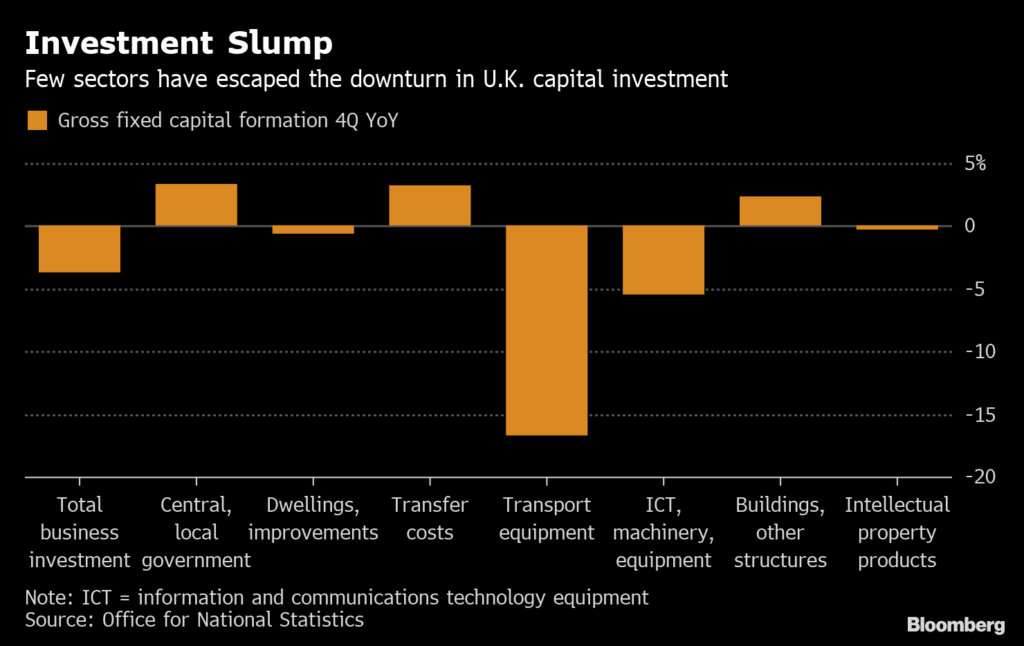

It works that way in business too. If you can’t see far enough ahead, you don’t make bets on the future; you slow to a crawl. That means stop investing for the future and conserve (hoard) cash. The best way to do that is to put all capital spending projects on hold until the fog clears. That’s what happened to the UK last quarter, as you can see in the chart below. And it’s not just happening in the UK.

The problem isn’t GDP, what most people mean when they say the economy. All major areas in the global economy will show positive growth this year. The problem is event risk, the possibility that a major event will derail our plans. There is always some event risk, of course–asteroids happen–but today we are drowning in it. Here are just a few of the time bombs today:

- Mueller risk. If Trump goes, so do the tax rates that are baked into current profits and stock prices. You can’t approve capital spending projects if you don’t know the tax rates during the life of the project.

- Brexit. Nobody has a clue how it will play out so it makes sense to hold your fire on capital spending until you know how it will play out. this has undermined spending in both the UK and the broader EU.

- China debt. companies in China borrowed more than $1 trillion in dollar-denominated loans during the Fed’s zero interest rate period. Now both interest rates and the dollar are rising, increasing both the interest costs and real burden of the debt in local currency. Investor concerns about the debt have triggered capital outflows, which further weaken the RMB and shrink liquidity. Add the fact that the government has clamped down on non-bank shadow-loans and peer loans and you have a credit crisis for private Chinese companies. So far, the hail Mary’s thrown by the Chinese central bank (PBOC) have not solved the problem.

- Did I mention the trade war?

- Venezuela and its implications for oil prices…

As I wrote in an earlier post, the real risks for managers and investors is not recession; it is the potential seizing up of the credit markets that could be triggered by these kinds of events.

Of these, the most interesting one to me is Brexit. Prices have already been beaten down by the fear of what might happen. Britain will hit the fork in the road and go one way or the other quite soon. And once they do, a lot of the fog will lift to reveal that fact that the UK has been around for a long time, has an immense talent pool and all the other things (property rights, courts, IP protection, etc.) that make it easy to do business. And they speak English. At today’s prices, I like the UK as a long-term bet.

JR