Summary: Forces are building in the UK to revoke Article 50, tear up the divorce papers, and remain in the European Union. With or without Brexit, the UK is going to still be the global destination reposrt for wealth. It is an interesting invesstment opportunity today.

There have been so many China stories lately that I haven’t gotten to write about anything else. Last week alone, Robert Mueller delivered his report on Russian interference in the 2016 elections to the Dept of Justice but we don’t know yet whether they will “lose” the only copy before we see it. And UK Prime Minister May had her attempted vote on her Brexit deal blocked by a 400 year old rule that Parliament can’t vote on a previously rejected proposal again unless it is materially different, which it wasn’t.

So what’s next? There are formidable forces building to tear up the divorce papers and start again. This could be done by a simple vote of Parliament–the referendum was non-binding from the beginning. Given the fractured state of British politics, however, I think it would be put to another people’s vote, this time without the assistance of Cambridge Analytica and with the information we now have on what Brexit would mean for the British economy. In the event that young people wake up early enough to vote next time, I believe Brexit would be soundly defeated. Should that take place, we would see an immediate jump in the value of the pound, a pop in British stock prices, and forecasters climbing over each other to raise their growth estimates.

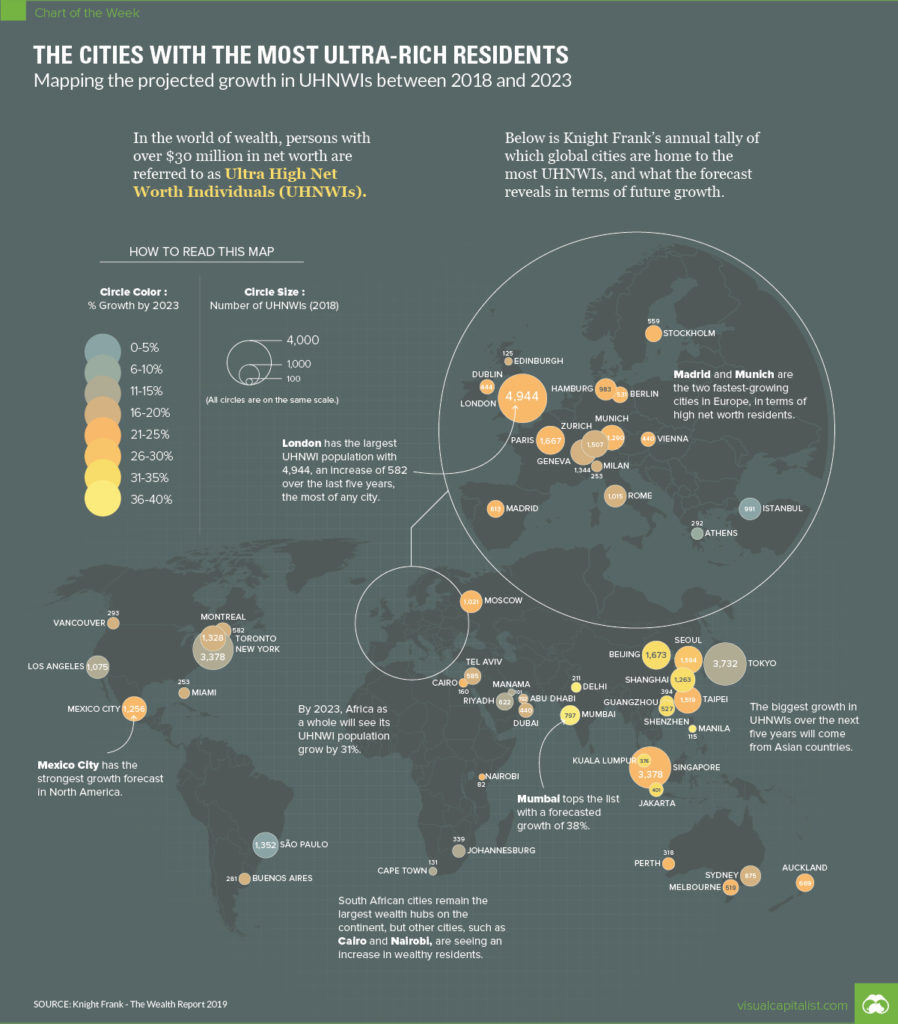

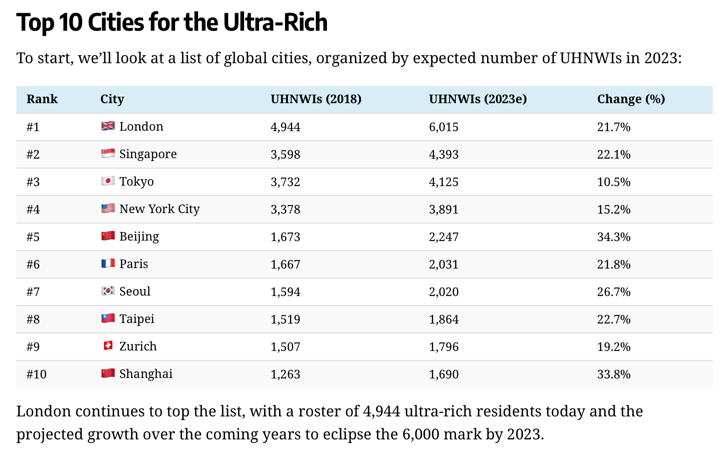

I have felt for some time that there are interesting investment opportunities in the UK, especially with the pound and British asset values depressed by the barrage of bad press surrounding Brexit. The attraction of the UK for global investors is not a question of tariffs or regulatory schemes. It is British Law, British Courts, the English language, and the immense pool of people w ho know how to use those things to protect investors. That’s why the UK is such a magnet for billionaires, as you can see in the table and graphic below. (source: Visual Capitalist)

London’s 4,944 ultra-rich families (projected to grow to 6015 in the next four years) makes it the world’s number one destination report for wealth ahead of Singapore, which shares the same list of advantages. The presence of all those billionaires from far away places, of course, along with the influx of workers from Eastern Europe and the fact that British workers’ incomes have not kept pace are some of the reasons behind the political unrest that triggered the Brexit vote in the first place. Those divisions are not going to disappear if Brexit goes away.

The decoupling of the economic futures of people who make their living from the balance sheet–what I think of as the net worth economy–and those who make their living in the income economy of GDP flows may be the most powerful economic disturbance of our lifetimes. In my next post I will go into the causes of that decoupling and its implications for investors.

JR