Summary: I posted these charts several months ago with a promise that I would write more to explain them. Well, I got distracted and didn’t do so even after a request from one of the best economists I know. I am posting it again and will write more tomorrow to explain it. It is the way to think about financial crises as phase transitions. I think it is the explanation for the impact of the coronavirus on the economy. We are suffering a cascading network failure. More below.

I want to warn you that this is a seriously nerdy piece so don’t blame me if you stare at it for a long time and suffer brain damage as a result.

Long ago I was a tenured Professor. Then I got bored and wandered off to do strange things. I advised governments, pension funds and big investors, helped restructure companies, started a mutual fund, founded a private equity firm, served on the boards of dozens of public and private companies, and got about 20 million air miles.

Then I started teaching PhD students again. What I saw being taught as macroeconomics blew my mind–and not in a good way. Here is a peek at how I teach it.

I still loved working with the students, which was the reason I started teaching in the first place. But I found that what passed for state-of-the-art thinking in both macroeconomics and finance made no sense to me at all. So I taught the stuff to the students, then taught them what was wrong with it, and finally taught them a framework I had developed over the previous 30 years that I think of as far-from-equilibrium economics to help understand what goes wrong when an economy falls out of textbook full-employment general equilibrium into financial crisis and ultimately fights its way back to health again.

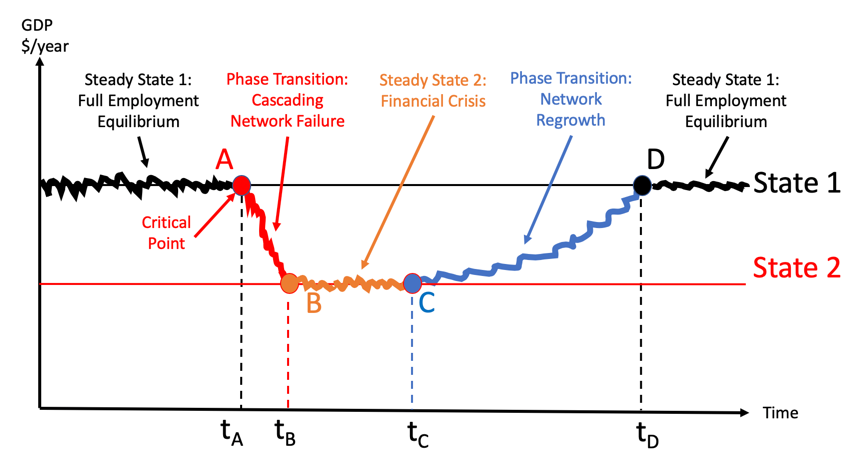

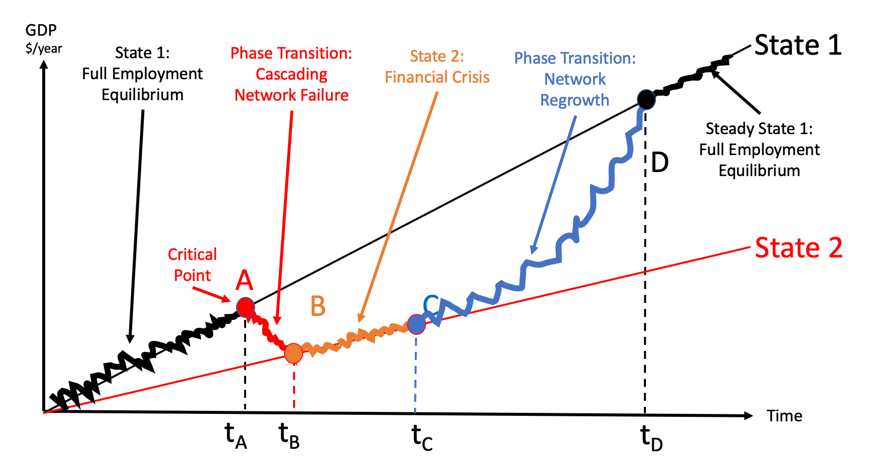

It’s a complicated story that requires understanding some unfamiliar ideas drawn from unfamiliar literature so I’m going to tell it bit by bit. In this piece I am only going to give you a few of the key summary graphs showing an economy initially cruising along at full employment, hit by a sudden financial crisis (something we will later call a cascading network failure), experiencing a phase transition to a recession state, eventually fighting its way back to general equilibrium as the network recovers.

The graphs, below, are the summary of the ideas we will develop in further posts. I hope to convince you that they represent a much more fruitful approach to macroeconomics and finance than the stuff currently described as accepted wisdom. I will also write about the investment strategies that make sense in this view of the world.

Needless to day, more to come.

JR