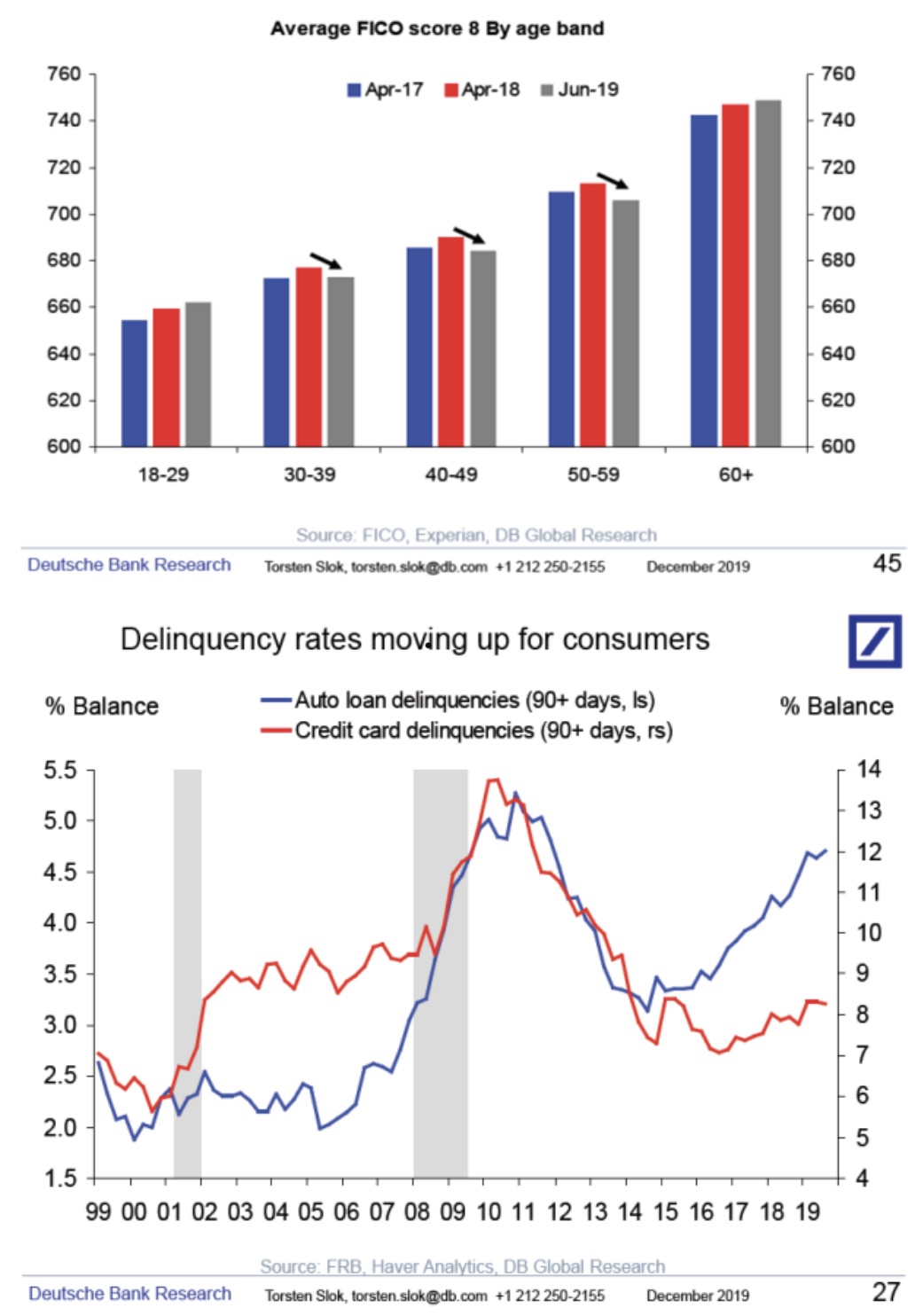

Two Charts from Torsten Slok at DB worth keeping in mind as we navigate our way through real estate and auto markets.

Worth noting that auto delinquencies are spiking in spite of moderate household debt/income, rising incomes, and the lowest interest rates in most people’s lifetimes. When interest rates eventually return to normal levels, loan payments will go up with them. Not so good.

Aggressive subprime auto lending and the CLO binge were the drivers of the extended and unsustainable 17 million unit auto production years.

The cascading network failures we know as credit crises are not triggered by recessions. They happen when some piece of information makes investors discover an emperor that has no clothes. The CLO market is the most likely trigger for the next financial event so worth watching carefully. Bottom line, the difficulties in the auto sector are likely to be worse 2 years from now than they are today.

JR