Summary: As often as I have discussed international trade and finance on CNBC, including earlier today on The Exchange, I always feel that we only have time to scratch the surface of such a complicated topic in our 5-10 minute discussions. So, I have decided to write a series of pieces here on the blog that, together, deal with that I think are the big issues. In this piece, I write about what I think David Ricardo would say about comparative advantage and free trade if he were here today. Hint: Not what you think he would say.

Don’t read the guy who wrote about the guy. Read the guy. Economists quote old dead guys all the time. Unfortunately, they rarely read what the old dead guy really wrote because it’s easier to read what someone else wrote in a textbook or a review article. That’s why the first piece of advice I give my PhD students is “Don’t read the guy who writes about the guy. Read the guy.” In matters of international trade, David Ricardo is the guy.

Ricardo’s principle of comparative advantage is the bedrock of the case for free trade. We all know how it goes. England and Portugal both produce wine and cloth. English workers are relatively more productive at producing cloth; Portuguese workers are relatively more productive at producing wine. If England shifts some resources from producing wine to producing cloth and Portugal shifts some resources from producing cloth to producing wine, trading British cloth for Portuguese wine, people in both countries have more goods to consume. Voila! Free trade is good for everybody. But that’s not what he really wrote.

When you take the time to actually read Ricardo you learn that he knew his entire argument rested on his assumption that capital and labor can’t move between countries to take advantage of profit or pay differentials so the only way countries can interact is to trade the output of farms and factories. That may have been true in 1817, when Ricardo wrote The Principles of Political Economy and Taxation, but optical fiber and electronic capital markets have made just the opposite true today. Capital now moves between countries invisibly, at the speed of light, at very low cost. Certain professional labor services–legal, accounting, banking and certain diagnostic healthcare services–do the same but it is generally still expensive to move people around the world. But physical goods like cars, steel, and soybeans, still have to be shipped in containers on slow, expensive ships. If Ricardo were alive today he would be smart enough to know that he would have to tell his trade story in a much different way that would turn comparative advantage on its head.

First, a little history. Ricardo was born in 1772, learned stockbroking in his father’s business, was wildly successful on his own, and retired as a country gentleman in his mid-30s. Having read Adam Smith’s Wealth of Nations, he made a name as a thinker by writing a series of letters on the price of gold and a pamphlet advocating for a return to the gold standard. But it was his pamphlet, An Essay on the Influence of a Low Price of Corn on the Profits of Stock, arguing in favor of free trade of grain products, that won him the admiration of James Mill who convinced him to expand his Corn Law arguments for free trade into a book and to buy a seat in Parliament (You could do that then) so he would have a bigger pulpit to preach from. The book, Ricardo’s Principles, was published in 1817. The Law of Comparative Advantage is presented in Chapter 7 as an argument for free trade. I have copied paragraphs from Chapter 7, below, to show how he developed his arguments. My advice, however, stands–read the guy yourself.

- In the first passage, below, Ricardo reminds us that Adam Smith’s Invisible Hand works within each country, allocating capital and labor to their best use. And he states, without proof, that the same principle works between countries.

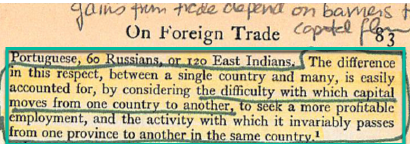

2. In the following 2 clips, which should be read as a single paragraph, Ricardo describes how mobile capital will be redeployed to eliminate return (the profits of capital) differentials within England, but tells us not to expect the same thing to happen between countries. To Ricardo, each country is a closed system. Arbitrage takes place within a country but not between countries.

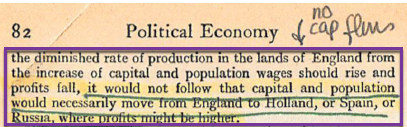

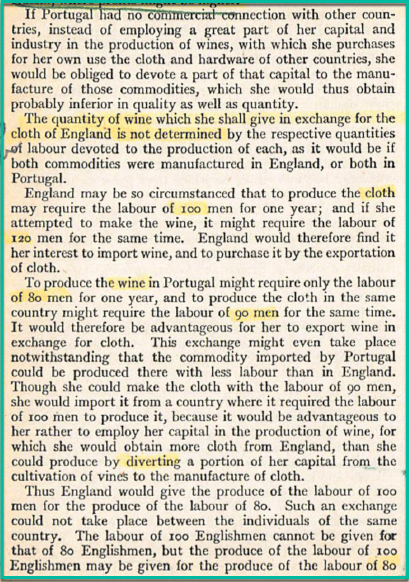

3. Ricardo gives the clearest statement of the law of comparative advantage, which he referred to as the law of comparative cost, in the text below from pp. 82-83 of the 3rd edition. He gives the example familiar to every principles of economics student that, by trading English cloth for with Portuguese wine, England may be able to acquire wine at a lower labor cost that could be done without trade, which could be accomplished by partial specialization, by shifting labor and capital resources at home from producing wine to producing cloth.

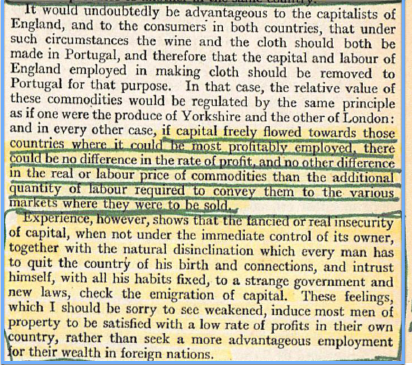

4. The reason this works, he writes below, is because immobile capital has not been able to eliminate return (profit) differentials across borders. In other words, trade in goods is a way of accomplishing, at least in part, what could be accomplished more easily by simply redeploying capital. Why don’t owners of capital redeploy it across national borders to profit from return differentials? To Ricardo, it was because they just don’t feel comfortable doing it, which is referred to as home bias in the modern behavioral finance literature.

5. Ricardo’s assumption that neither laborers or owners of capital could leave the country allowed him to treat them as a single unit of analysis. And by showing that trade increased the amount of goods that can be consumed within England he was able to make the welfare argument that, at least jointly, they were better off. Workers and capital owners, in effect, can be viewed as a single nation. But once you allow owners of capital to own capital in both places you lose the ability to make the argument because capital leaving a country effectively shrinks it ability to produce goods. Students of economics will remember seeing the argument made in class by starting with production possibility curves for both countries. Ricardo’s assumptions leave those curves intact. Mobile capital shrinks the PPF of the country losing the capital and increases the PPF of the country gaining it.

Home bias still exists, of course, and there are sound reasons why investors prefer to invest in things close to home that they understand over those far away that they don’t understand. But it is also true that capital flows across borders today are many times larger than goods flows, reflecting better information and lower redeployment costs.

It is clear to me that, if Ricardo were here today, he would tell the story differently. Opening trade between countries that had different resource endowments and different relative prices would trigger redeployment of capital, labor, and goods (trade), which would drive the full set of relative prices closer together. That would certainly increase total production for all countries combined. But it would not result in the free trade argument that each nation’s output goes up as a result.

To put names to the story, opening trade between capital-rich America and capital-poor China has induced capital owners to redeploy it from where it is abundant to where it is scarce. The capital owners–today we call then the 1%–are unambiguously better off as a result. Workers in China are better off because they are not more productive. Workers in the US are now worse off because they have fewer factories and machines for producing product.

I first put this analysis together more than 20 years ago and gave many lectures about it. I thought it was important because it implied there would be a kind of economic divorce between owners and workers in the US–I described it as an economic civil war. What I got back was mostly yawns–people simply were not interested. Looking back, I think it has a lot to do with the rise of populism here and in Europe that has pushed the world into the trade war that weighs on the global economy today.

JR