Summary: Yesterday morning I woke to the news that the U.S. had launched a drone strike near the Baghdad airport, killing Iranian General Soleimani. An hour later, I did an interview on CNBC’s Squawk on the Street to talk about the impact on global markets and the outlook for the coming year. My view: last year’s extraordinary run-up in stock prices was all Fed, no profit growth, making markets especially vulnerable to a number of event risks that you could wake up to in the coming months. It is prudent to remain defensive and hold extra cash at this time. You can see a video clip of the interview by clicking here.

When anchor Contessa Brewer asked me what I thought of the event I confessed that my first thought when I heard the news was that I had flown over the Baghdad airport twice in the past month and I was glad not to be doing so today. The markets clearly didn’t like it either; the air pocket opening illustrated just how exposed to event risk stock prices are today. That’s why I want to keep a defensive investment posture going into 2020.

(As an aside, I am also glad I am not in San Diego today, where some 3000 economists have collected for the annual meeting of the American Economic Association. With that much maximising going on in a relatively small city, there’s no telling what could happen. And I send my condolences to all the waiters, waitresses, and bartenders in San Diego who count on tips for their incomes. It’s going to be a bad week.)

The stock market in 2019 was all hat, no horse. The almost 30% price increase was manufactured out of thin air by the Fed and other central banks, as shown in the chart below, courtesy of Ritesh Jain.

But profits didn’t increase at all, as you can see in the chart below. Current analyst estimates suggest that profits will not grow at all in 2020.

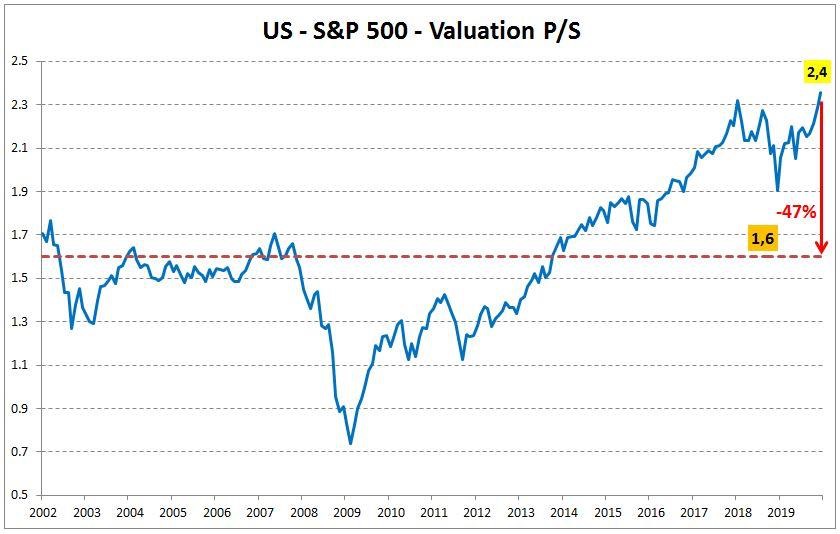

When prices go up and profits don’t, the result is a spike in valuation multiples, as you can see below in price/sales ratios. And it’s not just sales; price-to-anything ratios (sales, earnings, EBITDA, dividends) would look the same. And it’s not just stocks; multiples are up in private equity, real estate, collectibles, and bonds too. Today’s high valuation multiples are simply the reflection of the low interest rates (high bond prices) caused by central banks flooding the market with liquidity.

If 3,000 years of economic history show anything, it is that rampant money printing by central bankers who think they know what they are doing is not sustainable. Sooner or later prices go up and interest rates rise, or they are forced to stop the presses and interest rates rise. With valuations at current levels, I am going to remain defensive as an investor. That means larger than normal cash holdings, concentrating on boring cash-yielding investments, low refinancing risk and no leverage. I may leave some money on the table with that strategy but I will sleep better at night knowing I won’t wake up some morning to some other event bigger that this one wondering what to do to protect capital.

JR