Summary: Long ago, Friedrich von Hayek published two brilliant papers describing a price system as an information network. Since then, thousands of scientific papers have been published in network theory. Epidemiology is the study of how a pathogen like the coronavirus is transmitted across a network within a defined population. Financial crises are pandemics too and follow the same mathematical dynamics. Today, there are significant risks of financial crises in Chinese financial markets, discussed here, and in the junk-laden Western credit markets, which I will discuss in my next post.

In my last post, I wrote about the systems dynamics models used by epidemiologists to study the way a pathogen like the coronavirus is communicated across a population. I use these models in a course I teach to PhD students called Far From Equilibrium Economics, that examines the cascading network failures we know as financial, credit, and banking crises. You can download the reading list for that course here.

In first lecture I take the students through two brilliant papers Friedrich von Hayek wrote (Economics and Knowledge, his presidential address to the London Economics Club in 1936, and The Use of Knowledge in Society, published in the American Economic Review 1945) where he described a market economy as a communications network that transmits information about changing wants and scarcities to just the right people who need it so they can make decisions and do their jobs. These are, by far, the two most important papers ever written in economics. You can download a PDF of both papers below. (sorry for all the margin notes–I don’t read papers, I consume them.)

Von Hayek was a harsh critic of static equilibrium analysis based upon the notion that people have perfect information.

…there is something fundamentally wrong with an approach which habitually disregards an essential part of the phenomena with which we have to deal: the unavoidable imperfection of man’s knowledge and the consequent need for a process by which knowledge is constantly communicated and acquired… Any approach, such as much of mathematical economics with its simultaneous equations, which in effect starts from the assumption that people’s knowledge corresponds with the objective facts of the situation, systematically leaves out what is our main task to explain. (The Use of Knowledge in Society, p. 91)

The process von Hayek referred to in the above quote is the price system which transmits a signal we call price to transmit information across the network:

The price system is just one of those formations which man has learned to use…after he had stumbled upon it without understanding it…man has been able to develop that division of labor on which our civilization is based because it happened to stumble upon a method which made it possible. (p. 88)

We should keep in mind that, at the time von Hayek wrote these papers, Shannon had not yet published the paper A Mathematical Theory of Communication (1948) that gave birth to Information Theory and network theory was not yet a field of study. Von Hayek also invented what we today refer to as “neural networks” in an unpublished manuscript written when he was 19 years old. It was only published in 1952 as “The Sensory Order.”

Network theory has blossomed into a rich area of research since von Hayek’s papers, especially in physics where thousands of papers were written about two related subjects, 1) the systems dynamics of how networks form and occasionally experience cascading failures (associated with Albert-Lázló Barabási, Linked: The New Science of Networks), and 2) how seemingly stable systems experience sudden, radical change, such as avalanches, earthquakes, and tsunamis (associated with Per Bak). Like financial panics, these system events, known as phase transitions, occur when individual particles, or agents, lose their ability to behave independently and lock into orchestrated behavior. In economics we know then as financial crises.

Per Bak, Power Laws, and the Mathematics of Avalanches

Sadly, most macroeconomic models, including the ones used by the Fed and other central banks, presume that emotionless, identical people are quietly making independent decisions and not paying attention to each other. That explains why economists have so little to say about financial panics, situations where the interactions among people dominate their behavior and the entire system locks into hyper-correlation.

A great deal of research is going on today to try and isolate statistical markers that show the probability that an impending phase transition or system collapse is about to happen. Early results have isolated half a dozen markets that show promise, including autocorrelated movements, variance spikes, and slowing recovery time. There is also compelling evidence that statistical distributions of returns are not even close to the normal distributions we see in textbooks. Instead, they appear to be “power law” distributions that have extremely long tails, i.e., positive but low probabilities of extremely large positive and negative changes.

We can paraphrase physicist Per Bak’s summary, in “How Nature Works,” of the scientific literature on complex behavior as saying that in nature, to a first approximation, all changes are small, but all change is big. Catastrophic change (like avalanches and financial crises) doesn’t happen all that often, but when it does it dominates all of the small changes that happen every day. Financial markets work the same way.

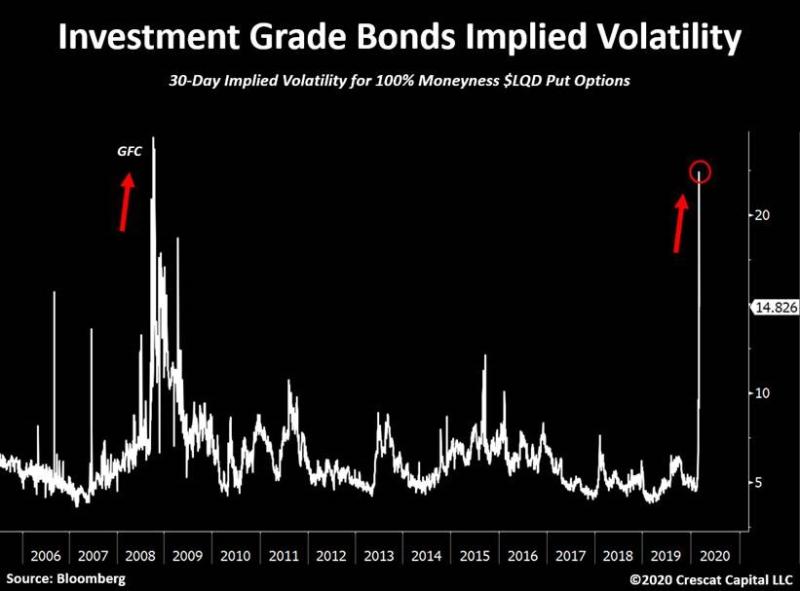

Risk of Catastrophic Change Today

There are reasons to worry about the risk of catastrophic change today. On the positive side, US GDP is growing, unemployment is low, and the Fed appears ready to print money at the first whisper of trouble. But profits are flat, income growth is weak, and the coronavirus could bring growth to a temporary halt. Both bond and stock valuations are stretched by any rational measure. The odds are growing that later this year we will suffer through an extremely toxic and polarized election. And Trump vs. Sanders would not just be a clash of “isms”, it would be a clash of marginal tax rates with enormous implications for the US and global stock prices.

But the epicenter of a global financial event, if one were to happen, would more likely be in China. The problem is not the risk of the “hard landing” everyone always worries about, the trade war, or even the coronavirus shutting down growth; it is the underdeveloped Chinese financial system. Anomalies include a banking system that was designed to lend money to giant state-run companies (SOEs), not the small, private companies (SMEs) that are the engine of almost all output and employment growth.

Over the past two years, the government has clamped down on “shadow” lending, which has killed peer-to-peer lending and pushed shadow banks into calling loans instead of making them. Chinese corporate debt is extremely high, and some $2 trillion of it is dollar-denominated, which becomes more burdensome when the RMB falls against the dollar. And a large percentage of the shares of SMEs are pledged as collateral for bank loans. I believe the proximate cause of the next global financial crisis, when it happens, will likely be triggered by financial events in China that are transmitted, like a virus, to the global banking system. In my next post I will focus on what investors can do to survive and prosper in a world where financial panics are a rare but important fact of life.

JR