Summary: My last post discussed the conversation I had with Kelly Evans, anchor of CNBC’s The Exchange, on the impact of the coronavirus on global markets. In this post, I lay out the basics of the mathematical contagion models that epidemiologists use to understand how a pathogen spreads across a vulnerable population. I conclude with investment strategies that make sense in a world where financial crises happen more often than many like to admit.

Pandemics are Cascading Network Failures

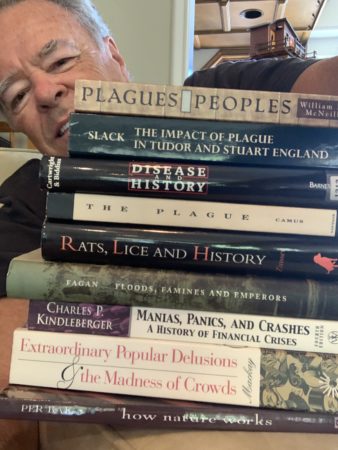

Now for a few of the thoughts that didn’t make it into the show. I know I will be accused of being morbid but as much as the coronavirus is terrifying, depressing, confusing, devastating, and all the other ‘ings’, it is also interest-‘ing.’ I have an entire shelf of books on the history of plagues and disease to prove it; you can see a few of them are below. I will write more about them in the next post.

I have no more idea how fast and how far the virus will spread before it runs out of steam than anyone else, but I do know some interesting things about contagion. I teach a graduate course in far-from-equilibrium systems dynamics where we spend a lot of time reviewing scientific papers on the mathematics of contagion, which boils down to how fast a signal (in this case, the virus) can be communicated across an information network (a population), by studying the behavior of a class of mathematical epidemiology models known as (SIR).

Plagues, SIR Models, and the Epidemiological Threshold

The SIR model has been around since Kermack and McKendrick proposed it in a (1927) paper, “A Contribution to the Mathematical Theory of Epidemics,” to study the rapid rise and fall in the number of infected patients in historical plagues and epidemics such as the London plague (1665-1666), the Bombay plague (1906) and cholera in London (1865). You can read about SIR models by clicking here. And you can play with your own models using the free agent-based modeling software called NetLogo by clicking here.

Since then, SIR models have been refined and used to study many historical epidemics. Examples include: the Antonine Plague (5-10M deaths, 165-180 AD); the Plague of Justinian (45-50M deaths, 541-542 AD); the Black Death (75-200M deaths, 30-60% of population, 1331-1353, which caused a labor shortage so severe that some credit it as the cause of the end of the feudal order and rise of the British middle class, collapsed the price of rags–when people die they leave their clothing behind–in the Rotterdam rag market, and drove down paper prices, accelerating book publishing in Europe); the Mexican epidemics (7-17M deaths in two waves, 1545-1548, and 1576-1580); the Great Plague of London (“only” 100K deaths, 1665-1656, but famous because, while holed up in his country home, Isaac Newton invented both differential calculus and the theory of optics); the Spanish flu (up to 100M deaths, 1918-1920); the Asian flu (2M deaths, 1957-58); the Hong Kong flu (1M deaths, 1968-1969); SARS (500 deaths, 2002-2004, a coronavirus); MERS (500 deaths, 2012, a coronavirus); and of course HIV/AIDS (30M deaths, 1960-present).

In an SIR model, a specified number of agents wander around a closed landscape and occasionally bump into each other (think Brownian motion.) Each agent (person) is in one of three states: 1) Susceptible, meaning the agent doesn’t have the virus but is susceptible to catching it if it comes into contact with an infected agent; 2) Infected, meaning the agent has been infected with the virus and is capable of passing it on to a susceptible agent; and 3) Recovered, one who has been infected and recovered or is now immune. A probability is assigned to each encounter. For example, there is a probability that an “S” will become infected should they bump into an “I” and a probability that an “I” will recover from the disease and become an “R”.

The most important control variables for contagion are 1) density, the number of agents occupying a given unit of landscape, 2) activity, how quickly a given agent moves around the space, and 3) incubation period, the length of time an infected agent can wander around infecting other people without them being able to know the person is infected. Jointly, these metrics determine the critical metric for all epidemics known as the epidemiological threshold (ET), which measures the expected number of people that a single infected person will in turn infect before he/she either recovers or dies. If the ET is less than one, the epidemic will eventually die out. If it is greater than one, the epidemic will spread across the landscape.

SIR models have also been used to study contagion across networks in all kinds of situations, from ecological collapse, to forest fires, to financial crises. Their properties are very well known.

Sadly, most macroeconomic models, including the ones used by the Fed and other central banks, presume that emotionless, identical people are quietly making independent decisions and not paying attention to each other. That explains why economists have so little to say about financial panics, situations where the interactions among people dominate their behavior and the entire system locks into hyper-correlation.

JR