Summary: Driving in a heavy fog is difficult, frightening and exhausting, as every investor knows today. Slow down, be defensive, and keep moving forward.

I took this photo today while driving my daughter to school. It is a perfect description of how how I feel trying to to make decisions today an an investor, as a business owner, and as a person. I’m pretty sure that you feel the same way. It is debilitating.

I have experience driving in heavy fog. Some years ago, we lived in Lake Arrowhead. There was only one way to get there, a 26 mile drive up the mountain on “Rim of the World Drive,” a steep, narrow road carved out of the side of a mountain with sheer drop-offs to the valley below. Scary enough on a sunny day. Petrifying late at night in heavy fog.

Once you’re in it, there is no turning back. You can’t see far enough to turn around. You are afraid to go forward lest you stray from the road and drive off the cliff. You are afraid to stop for fear that another car will hit you from behind. So, you crawl ahead, holding the driver’s door open just enough to see the white center line you are tracking to make sure you are still on the road, hoping for the best, and vowing never to get into that situation again.

Sound familiar? I have been following the economy and financial markets for half a century as an economist, an investor, and a business owner. I have never seen a political and economic fog as thick as the one we are in today. I yearn for the good old days when all we had to worry about were the trade war, Brexit, and overpriced financial markets. Now we have a global pandemic, the sharpest drop in output in the last century, a series of multi-trillion dollar rescue packages, a $3 trillion budget deficit, government debt that has, for the first time since World War II, exceeded GDP, and a central bank that has all-but nationalized the bond market. We are 3 weeks from an election with fake-militia vigilante groups threatening to disrupt the voting. There is still a trade war. Financial markets are even more overpriced.

Investors everywhere are looking for solid ground to stand on so they can make decisions about their portfolios. Just like driving in a fog, doing nothing is not an option. Every dollar in a portfolio must be held in assets denominated in some currency, within some asset class, with exposure to many risks. Here are a few thoughts on how to manage our way through the fog so that a year or two into the future, when we can see down the road again, we will be in a position to take advantage of the opportunities in front of us.

Slow down. Be defensive. Keep moving.

The first step is to realize, and admit, that you can’t see far enough down the road to make major new investment decisions and that nobody else can do so either. We don’t know when there will be safe, effective vaccines of sufficient quantity to make most people feel comfortable going back to work and resuming normal activities, the necessary condition to returning employment and output to normal levels. Until we do, we will have no way of knowing how long the government rescue actions will continue, or their implications for the size of deficits and debt we will have to clean up. The biggest mistake we can make is to pretend that we have all the answers. That means we should slow down, be defensive, reduce risk, keep moving forward and do whatever is needed to protect the value of the assets we already own.

COVID and its Aftermath

The first thing to understand about the impact of COVID on the economy is that it is not a recession and there won’t be a recovery, at least not in the normal sense. Those are words economists use to describe the periodic slowdowns in employment and output that happen when people, for one reason or another, slow down their spending. And it’s not a financial collapse like the subprime debt crisis we lived through just a decade ago. Instead, as shown in the chart, below, COVID has triggered an economy-wide work stoppage that happened because people are afraid to go to work.

The COVID pandemic’s impact on the economy is not much different than if there were a massive labor strike–a sharp drop in the number of people working, a sharp drop in our output of goods and services, shortages and rising prices of certain goods, and a sharp drop in spending as families tighten their belt to weather the storm until we are all working again. All of those have happened during COVID. The big difference between COVID and a labor strike is that there will be no quick ending. Instead of agreeing to a new contract and going back to work, the COVID economy will only improve when people, one at a time, feel that it is safe to go to work, to eat at restaurants, and to fly on airplanes again. That will not happen until there is a reason for doing so, which means a safe, effective vaccine, available to enough people so the risk of a person becoming infected while going about normal routines is negligible.

There is no chance at all of that happening this year. We should see progress in 2021 as vaccines are released and a growing portion of the population have had their arm jabbed. By the end of 2022, most of the people in the US and other rich countries who want it will have been vaccinated and we will have forgotten just how scared we all were. That makes 2023 the first year we should expect a more normal economy, with most people back to work and output humming along again.

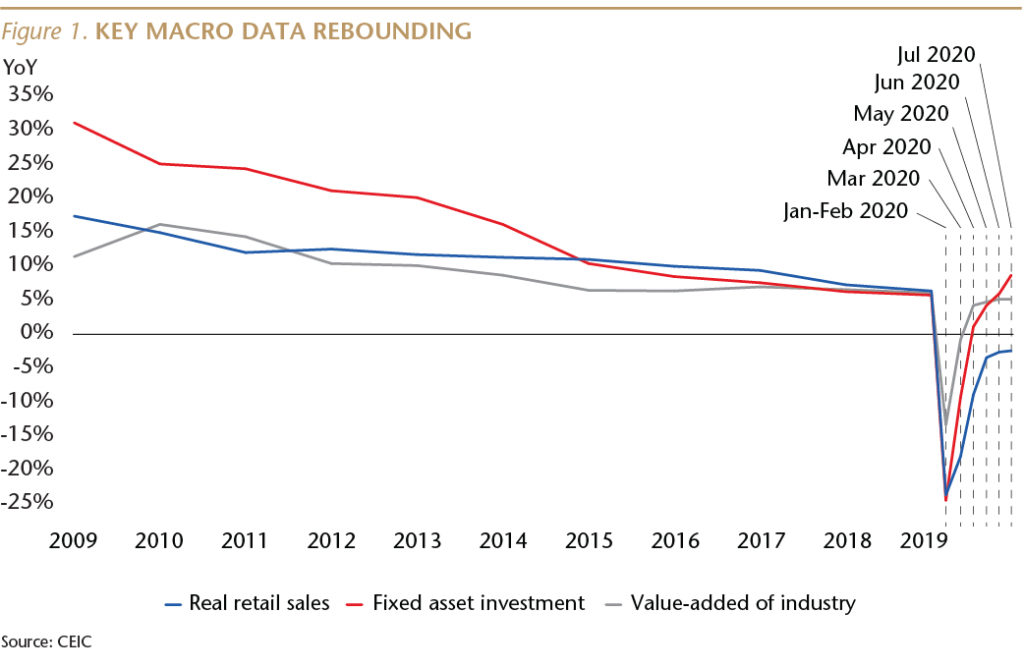

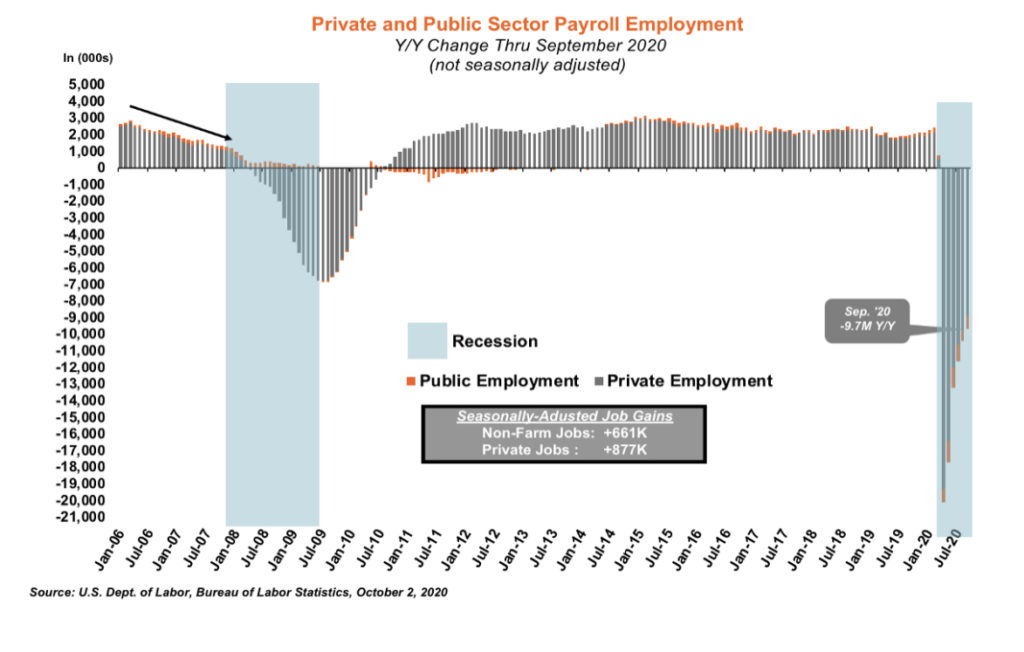

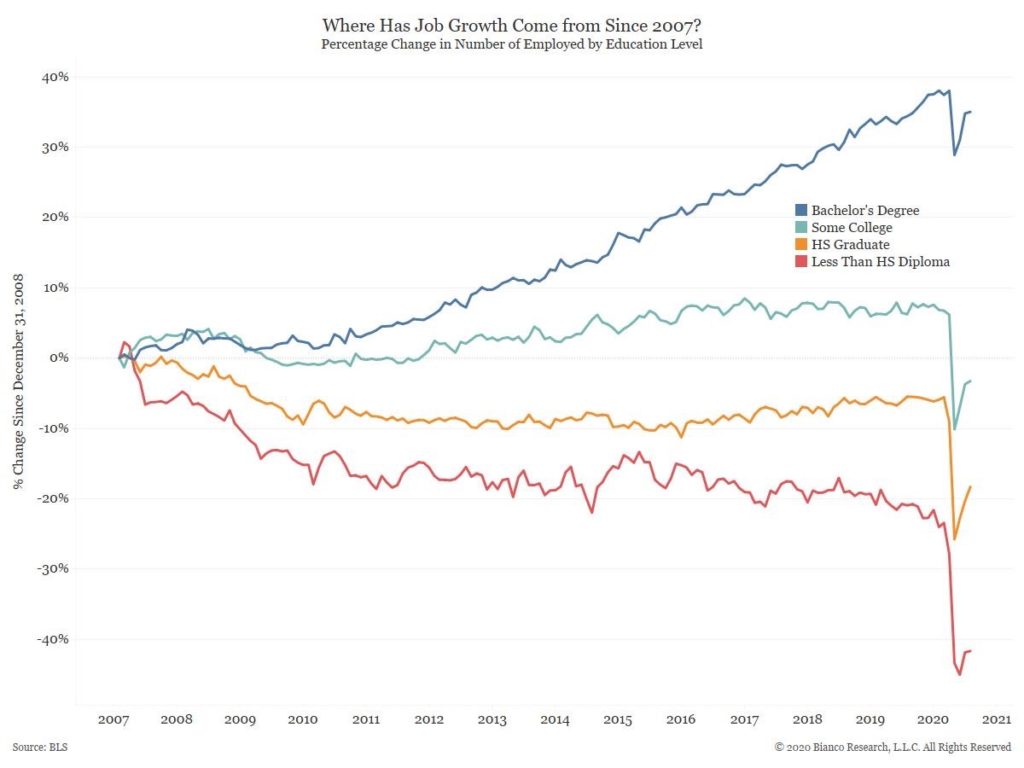

Don’t be misled along the way by economic reports showing big growth rates. As you can see in the jobs chart, above, employment fell off a cliff in April and has been growing since but we are still almost 10,000,000 jobs in the hole for the year, almost double what we experienced at the worst of the last bust. It will take a lot of quarters of double digit growth rates to repair this much damage.

Some of the damage will be permanent. We will eventually return to full employment but without the capital goods that we failed to produce during the pandemic. So, full employment output will be lower than it would have otherwise been.

The COVID economy, of course, is not an equal opportunity disaster. Highly-educated professionals have largely been able to work from home so not many job losses there. But, as you can see in the chart above, the COVID economy has not been as kind to everyone else. A chart showing job loss by income level, rather than education level, would show the same result.

After the Election

Some of the fog is about to lift. With the election just three weeks away, we aren’t going to have to wait long to learn the outcome. I won’t bore you with my prediction. The odds-makers, however, are becoming increasingly convinced that the result will be both a Biden victory and that the Democrats will control the Senate. That means Biden’s economic plan has a good chance of being enacted–tax rate hikes and all. I will look at the Biden tax plan in my next post and post a detailed analysis of the impact of its impact on each of the 10 stock market sectors before the election.

Market Timing Issues

It should be clear by now that I think it is prudent to be extremely defensive at this point. Markets were already overheated when the year started. The onset of the pandemic in March initially froze liquidity, raising fears of a financial collapse. Government stimulus programs were so large that household incomes in Q2 were higher than they were before the pandemic. Massive Fed purchases supported stock and bond prices. Government mandated forbearances on missed loan payments and the moratorium on evictions allowed households to build up cash reserves, and banks to report report loans with missed payments as performing loans. But the situation is not sustainable.

These efforts delayed, but did not prevent, a credit crisis. Sooner or later, the support programs must end. When they do, households that missed mortgage payments will find that the missed payments have been added to their loan balances and companies that took out PPP loans will find they are deeper in debt. And lenders will respond predictably by restricting credit. That will make the first half of 2021 very difficult. For patient investors with plenty of cash, however, this will present extraordinary opportunities.

Final Thought

I want to end on a positive note. No matter how thick the fog, as long as you keep going and don’t fall off the cliff you eventually break through to a place where you can see farther ahead again. I got home that night long ago. My daughter and I broke through the fog this morning (see photo below) and got to school (much to her dismay).

And one day we will get through COVID, the 2020 election, the trade war, and the overheated market. When we do, those who are especially careful today will have a rich menu of top quality investments to choose from. The key is to be there when that happens. Hang in there.

JR