(July 10, 2019). I am on a flight somewhere over the Midwest on my way to New York to meet with my good friends at Aoyama, Japan’s premiere wealth advisor. I just watched Powell’s House testimony on CNBC and wanted to lob in my view that he did a pretty good job.

His most important statement was in answer to the question (to paraphrase) “What would you do if you received a call from the President telling you that you are fired? His answer was the right one, that he would not leave. He will stay and serve his 4 year term as Chairman of the Board of Governors.

If we have learned one lesson from the last century, it is that central banks must be independent of the politicians who run the government. That’s the only reason inflation is 1-2% today, not 15% like it was in 1980. Politicians have short time horizons. Politicians debase currencies.

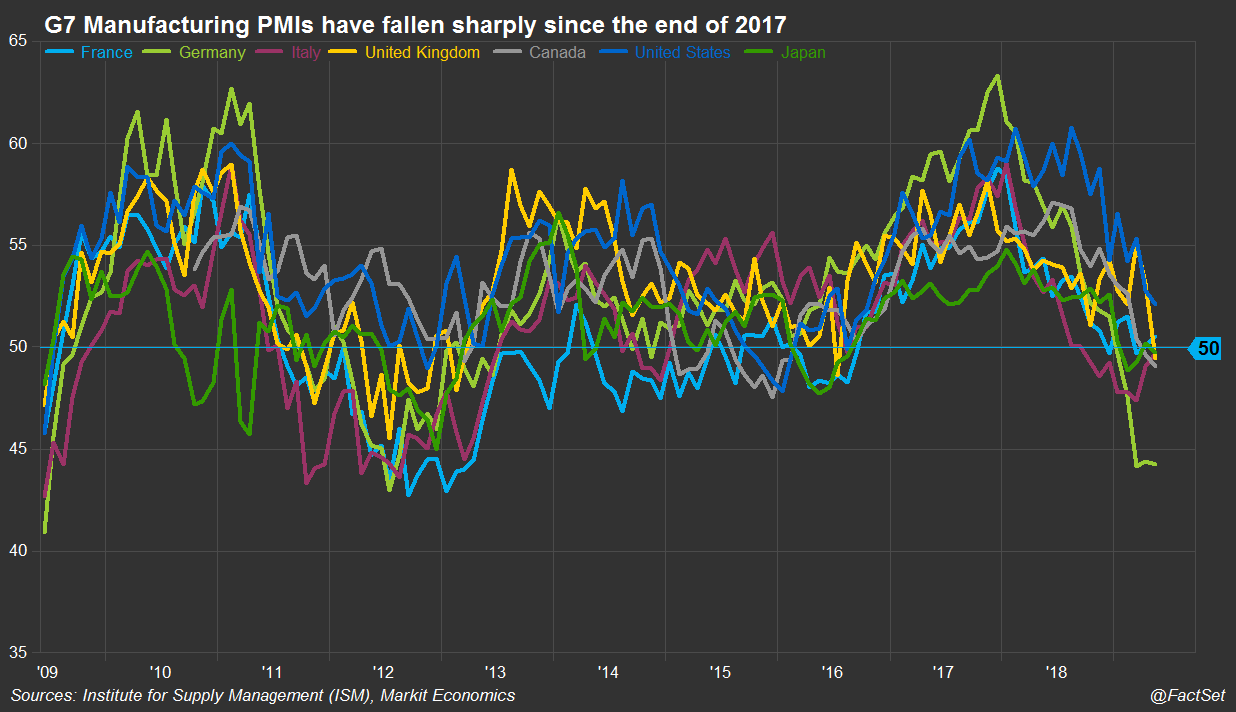

As to whether the Fed cuts the Fed funds rate by a quarter point in July or leaves it where it is today, I think it’s a toss-up. It’s clear that manufacturing is slowing everywhere and CPI inflation is OK, so a rate cut wouldn’t hurt. But you could get a bigger act by ending the trade war, the real cause of the global slowdown. And they don’t need Chairman Powell to do that.

In closing, as you know from my previous writing, I don’t buy the whole interest rate, recession story anyway. In my view recessions are triggered by financial crises that are best described as cascading network failures. They, in turn, are triggered by events that cause a loss of confidence in various financial institutions.

So, if there is a loss of confidence, what would be it’s likely cause? My top two candidates today are 1) leveraged loans that can’t be sold fast enough to meet redemptions (Powell mentioned that today), and 2) a liquidity crisis in the Chinese debt and interbank markets. Both are risky today. I am holding a lot of cash to protect against loss and to take advantage of fire sale prices should either occur.

JR

I agree that the market would react negatively at the end of July to no rate cut. Today’s ramp upward close to 3000 for SPX tells the story. Many market participants believe that Powell has a communication issue in that he often comes across more harshly than, perhaps, intended. If he were to fail to deliver a rate cut at the end of July, many traders and investors would be unhappy. Even worse, some believe it is the promise of a rate cut that is keeping the market elevated at these levels.

Me, I am hoping that economies around the world begin to show more stability. But as long as the US-China negotiations continue without signs of significant progress, I expect that the world will be on hold. Let’s hope that the negotiators can make good progress.

In the meantime, I, like you, expect a quarter point cut.

I’d be inclined to bet with you on this one, Kevin. Small cut is expected and won’t hurt anything but I don’t expect a big market req ruin. Think the market would react negatively to a no cut decision though. Thanks for your comment.

John

Looking at the CME Fed Tool, I note that the probabilities for a Fed rate cut have increased today compared to yesterday.

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html/

Target Rate (BPS)

Today:

– 225 – 250 (Current): 0.0%

– 200 – 225: 71.4%

– 175 – 200: 28.7%

Yesterday:

– 225 – 250 (Current): 0.0%

– 200 – 225: 96.7%

– 175 – 200: 3.3%

Given that the Fed disappointed the market in December, I fully expect at least a quarter point cut in July.