Summary: I had a wonderful time working with Kelly Evans on CNBC’s The Exchange last Friday. I had a great conversation with Kelly and guest Andres Garcia-Amaya about the Fed, the economy, earnings, and the trade war; I ran into my dear friends Sue Herrera and Bill Griffiths in the make-up room; and I was able to bring visitors from Japan on set to watch the show being made. Doesn’t get better than that. You can click here to see the short video of our hit.

Last week was a hoot. I had three days of meetings with the top people at Aoyama, select advisor to Japan’s ultra high net worth families, got to spend time with my colleagues at Safanad, and do a CNBC hit on set with Kelly in New Jersey.

I like doing Friday shows because the topics are a little broader and there is more room for thoughtful conversation. Today, we talked about the fed, the economy, the earnings announcements that started this week, and news from the front in the trade war. In this post, I will talk about the Fed and trade war and deal with the economy and markets in the next one.

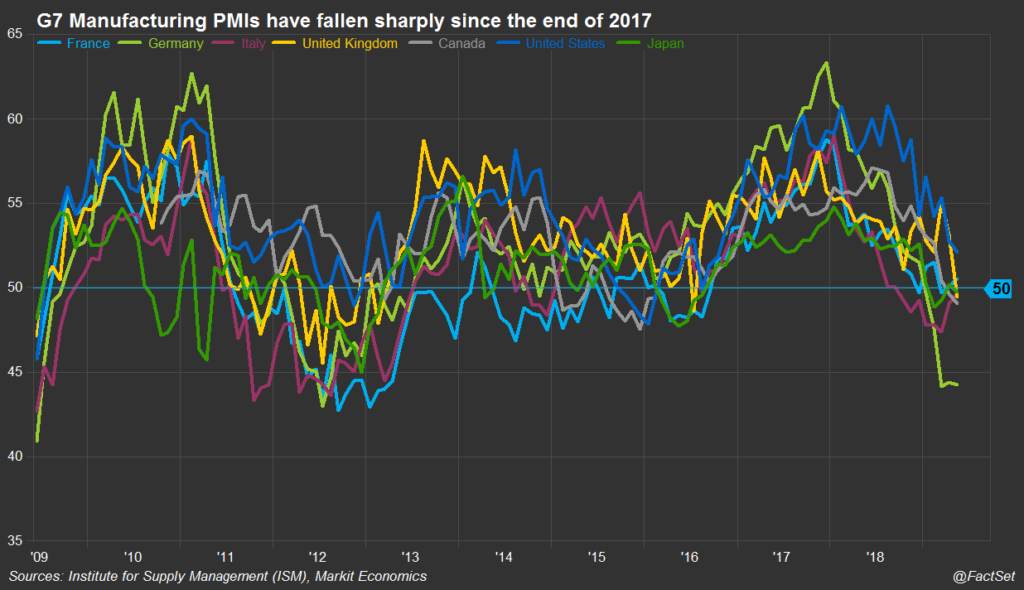

The Fed story that everyone is talking about is whether or not the Fed will lower the funds rate target by a quarter point later this month. Powell testified last week and has dropped hints this week that it’s confusing out there but the Fed is inclined to play nice. I can certainly understand the confusing part. PMIs are falling everywhere, as shown for the G7 countries below. The June US number (51.7), shows that manufacturing is still growing (the index is more than 50) but it’s down from 52.7 in May and the lowest reading since October 2016. But, as Kelly points out in her report today (you should get it) the June jobs report (+224K), retail sales, the Philly Fed report, and Industrial Production (+0.4%) were all positive surprises.

My colleague, Hisam Sabouni, and I have written a paper on the subject that I will post in the next day. We use Monte Carlo analysis of an estimate of the Fed’s reaction function known as the Taylor Rule to argue that Mr. Powell is right to straddle the fence at this point; the case for lowering the funds rate is not crystal clear.

But the Fed funds rate is the small story. The large story is the growing frequency and aggressiveness of attacks on the Fed’s independence. Central banks must be as independent of political pressure as possible for a simple reason–politicians always have incentives to print money. The next election is never more than 2 years away. It is always a good idea to stimulate spending.

The result is always the same–accelerating price increases. That was true when I worked in the White House in 1981 and inflation and bond yields were both 15%. It is just as true today when we the economy is operating at full capacity and the government is predicting a one trillion dollar budget deficit (that’s a one with nine zeroes after it) next year. Contrary to the opinion of economists who were born after 1980, inflation is not good for you and there is nothing to stop a central bank from inflating the price level and eroding the real value of government (and private) debt.

Turkey is this year’s poster child for thug politicians corrupting central banks. Erdogan has fired the head of central bank so he can set policy himself. (Remind you of anyone?) He has announced he is going to lower interest rates. The inflation rate is already 16%; the 10 year bond yield is 17.2%. Both are going higher as a result of Erdogan’s move.

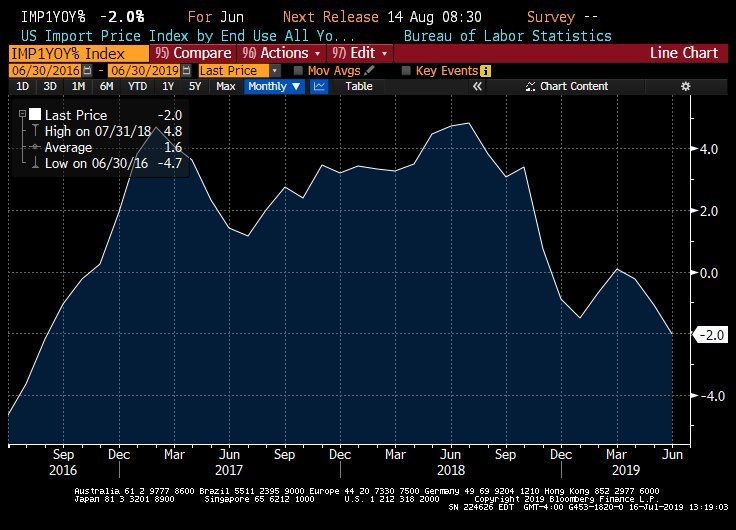

As a final point, I want to restate a point I made in a recent post. US tariffs are not having the effect on China’s economy that is being claimed by the White House. A 10% tariff on a specific list of Chinese goods will, in principle, raise their prices to US consumers by about 10%. But the Chinese currency (the RMB) is roughly 10% lower against the dollar than it was before the tariffs were announced, which lowers US dollar prices of the same goods by 10%. The net impact is zero. But the drop in the RMB also lowers the prices of all the other Chinese goods that were not on the list by the same 10%. The result is the net drop in US import prices that you see in the chart below.

But the RMB prices of all US goods sold in China will rise to reflect the 10% rise in the dollar (fall in RMB) and the prices of the specific US goods that are now subject to the 10% Chinese tariff will jump by 10% + 10% = 20%! Thats why, in the June trade report, China reported a small drop in exports (-1.3%) and a huge drop in imports (-7.3%), especially from the US (-31.4% LTM). For clarity, the drop in the RMB was not engineered by the Chinese central bank (PBOC). They have actually been trying to hold the RMB up. It was caused by global investors decisions to pull capital out of China. There are, however, serious problems in China’s economy as I explain to Kelly in the video. The top problem is a credit crisis for small, private firms who are starving for working capital. I’ll leave that to another post.

JR