Summary: The events of the past week have convinced me to elevate my risk warning flag from bright yellow to red-ish. Markets appear to have lost their sense of humor, no longer willing to overlook big problems and erratic behavior. I have moved an additional 10% from equities to cash in my personal portfolio.

The market has behaved differently over the last week. Instead of ignoring bad news and pushing prices higher, as it has done for some time, investors seem to be sobering up, paying more attention to negative surprises, and reacting to Tweetbursts by selling stock .

After being badgered by the White House to lower rates for weeks, the Federal Open Market Committee lowered the federal funds rate a quarter point last Wednesday. Markets yawned over the press release but dropped sharply during the press conference when but Fed Chairman Powell’s comments were less dovish than they had hoped. President Trump responded with a Tweetburst saying “Powell let us down” by not lowering rates even more.

The Mnuchin/Lighthizer trade team spent two days in Shanghai to reboot the trade talks with the Chinese team. After returning, they reported some progress and said the Chinese team would come to Washington in September to continue the dialog. But Friday morning saw another Trump Tweetburst announcing that the US would impose tariffs on an additional $300 billion of Chinese goods starting September 1. Markets didn’t like that either.

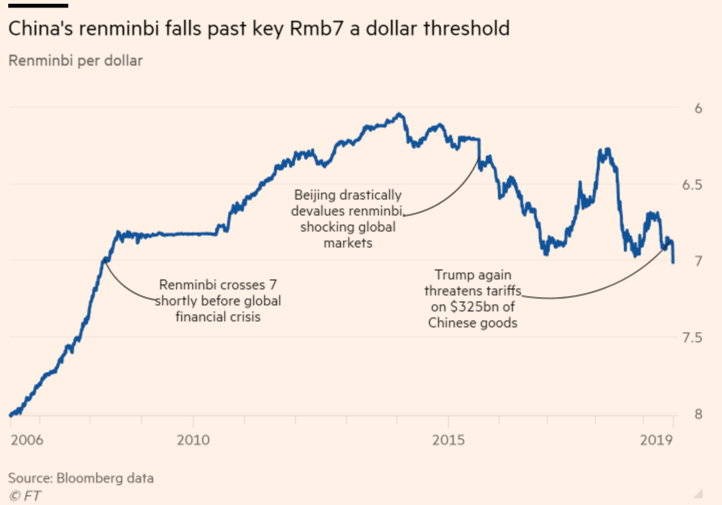

Monday morning, the foreign exchange market reacted by pushing the Chinese currency down sharply against the dollar, breeching 7 for the first time in more than 10 years, which triggered another early morning Trump Tweetburst saying the US will declare China to be a currency manipulator, which occasioned a hastily arranged press conference later in the day where Treasury Secretary Mnuchin said “yep, they are.” The Dow fell 800 points on the news

As a note: Declaring the PBOC to be a currency manipulator was a mental hiccup at best. The process for making that determination is well established and involved serious research by the Treasury Dept.; it has never been done on the whim of a Tweetburst. The PBOC has actually been selling dollars (buying the RMB) in efforts to stop it from falling. I know that Secretary Mnuchin knows this because I have discussed it with him. It was a bad decision to put the Treasury’s weight behind the claim.

Sudden stops in financial markets require two things to happen. First, income streams need to be fully priced so that markets are ripe for correction. I would argue that $15 trillion of government bonds trading at negative interest rates in global markets and a stock market that hatches unicorns at an alarming rate meet that test. Second, something has to happen to scare people enough that they lose confidence in the information–market prices, credit ratings, clearing mechanisms, solvency of counter parties, or even news sources–that they use to make decisions. The confidence loss leads to a sudden network collapse, much like when the lights go our during a thunderstorm. In my view, there are a number of factors that could provide the negative surprise needed to make this happen, including the trade war, riots in Hong Kong, violent demonstrations in Russia, a hard Brexit, an EU recession, or the sudden realization that a Trump election loss 15 months from now means all the delicious tax cuts that drove earnings up are likely to be reversed by a new government.

The thousands of scientific papers that have been written about the likely triggers of sudden network failures in nature all point to the same factors: autocorrelation (strings of negative days), a sudden spike in volatility, a behavior known as flickering, where there are short bursts of temporary, dramatic change, and fragility, or loss of resilience, in which disturbances take longer than normal amounts of time to return to stability, roughly the equivalent of today’s thin markets, low dealer inventories, and wide bid-ask spreads.

All of which makes me worried and more allergic to risk than usual. I don’t want to wake up one morning to find that a Tweetburst has shut down a market and taken away my ability to protect capital. The best time to hold cash is when it pays you nothing. I have moved an additional 10% of my personal portfolio from equities to cash. And within the equities, I would rather own Disney and Blackstone than Apple and Alibaba. I will write more about this later today.

JR