But then, that’s redundant, isn’t it? If I didn’t love the companies, I had no business owning their shares in the first place.

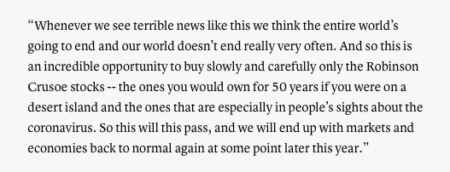

When investors freaked out about the coronavirus pandemic in late February, I advised CNBC viewers to view it as a rare opportunity to buy Robinson Crusoe stocks slowly and carefully, at deep discounts.

There aren’t many Robinson Crusoe companies but they are easy to spot–branded products, big gross margins, little need for capital, huge free cash flow margins, a government monopoly (we call it Intellectual Property) and little or no debt. Companies like Apple, Microsoft, Amazon, and Alibaba. In March, I wrote about just how hard it is to buy stock when prices are collapsing and every bone in your body screams “sell!” The only way I know how to help my brain beat my limbic system is to buy a little bit every day in amounts so small they don’t matter. Over several weeks they add up.

For the past few weeks I have had exactly the opposite problem. The Fed turned on the firehose, the government sent everyone checks, and stock prices have been driven up to ridiculous valuations. (Disposable income was actually a lot higher in the second quarter than it was in the months before COVID-19, as you can see in the chart below.) The stay-at-home amateurs (Robin Hood) have fallen in love with the stock market. Coronavirus numbers are rising again, and unemployment benefits are just about to run out. This is a time to sell stocks, not buy them.

But how do you sell down your position in the best companies in the world when prices are still rising? Slowly, in small amounts, every day. I sold a few shares yesterday. I sold a few today. I will sell a few again tomorrow.

But what if I’m wrong and prices keep rising? Then I will look like an idiot. But at least I won’t be a broke idiot.

JR