Summary: We don’t have to wait long for clarity on the election. At this point Biden is heavily favored to win and the Democrats have a high probability of taking the Senate. Congress will pass his tax plan, which sharply increases tax rates on investment income.

As I wrote in my last post, investors today are driving through heavy political and economic fog, unable to see far enough ahead to make decisions. Some of the fog, however is about to lift. With the election just three weeks away, we aren’t going to have to wait long to learn the outcome. I won’t bore you with my prediction but the odds-makers are becoming increasingly convinced that the result will be a Biden victory.

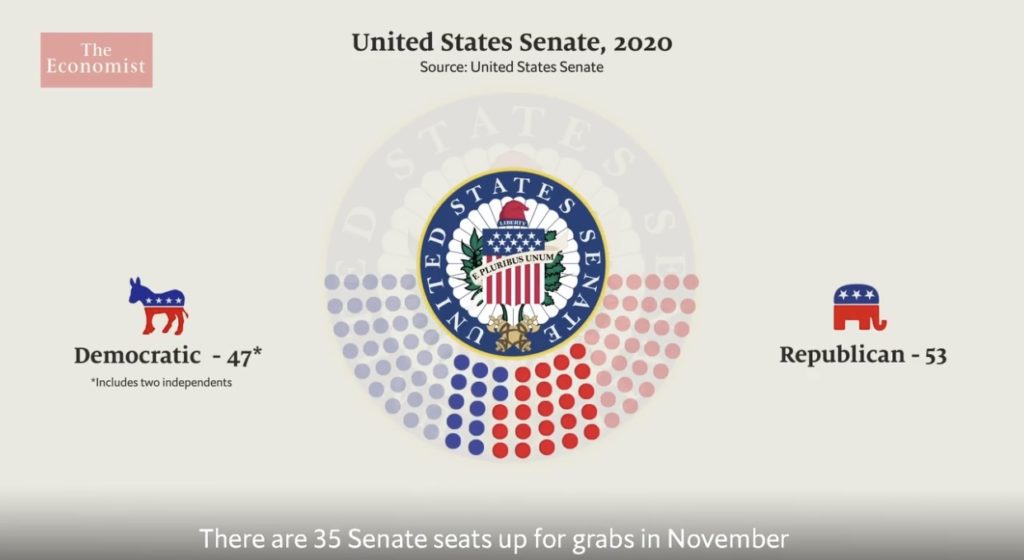

Just what a Biden victory means for the economy depends on who controls the Senate. A Republican majority in the Senate means they could block all major legislation. As the graphic above shows, there are currently 47 Democrats and 53 Republicans in the Senate. There are 35 Senate seats–12 Democrats and 23 Republicans–up for grabs in this election. The Democrats need to add 4 seats to control the Senate, but only 3 if Biden wins because the Vice President–in this case Kamala Harris–votes to break a tie when necessary.

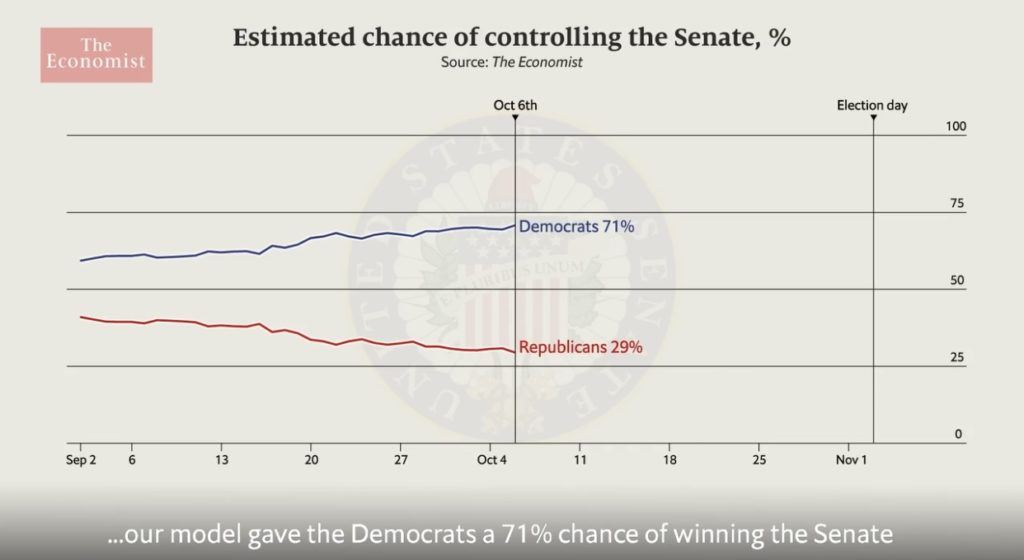

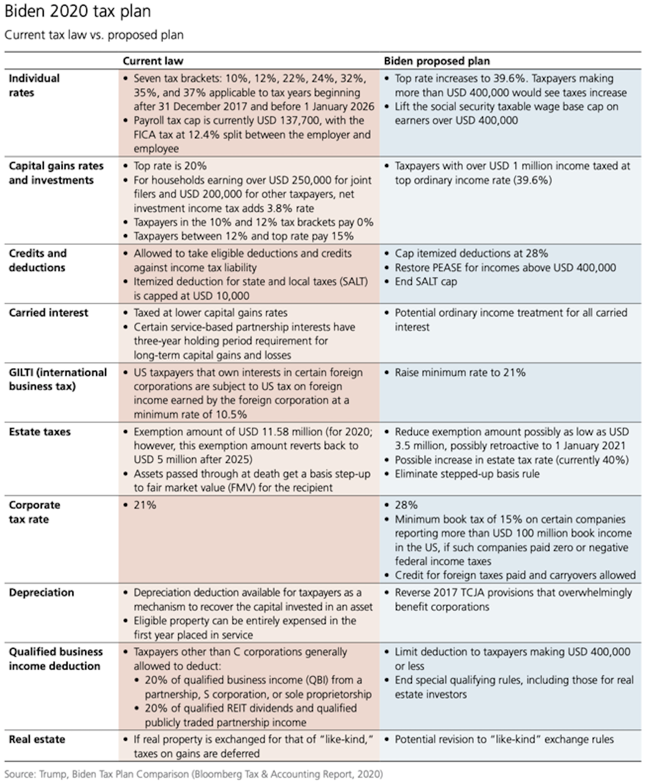

The Economist magazine has built a forecasting model that uses historical data from all major public opinion polls along with fundamental information such as economic conditions and demographic changes to predict the Senate races. The chart above shows the model’s current prediction–a 71% probability that the Senate will be controlled by the Democrats. That means Biden’s economic plan has a good chance of being enacted–tax hikes and all. The table, below, compiled by Bloomberg Businessweek, summarizes the major components of Biden’s tax plan. (You can find the details of the Biden economic plan at their campaign website.)

Investors–stand by for a ram. The Biden plan raises tax rates across the board, partly to pay for his proposed spending increases on healthcare, education, and environmental programs and partly to take a swat at “the 1% problem” so much has been written about. All of the proposed tax changes have significant economic effects but today I will focus on the elephant in the bathtub–taxes on investment income.

The corporate tax rate gets the most media attention but is small potatoes, partly because so many companies find tricky ways not to pay it. Biden plans to raise the corporate income tax rate by one-third, from 21% to 28%. More importantly, he has proposed changing the way taxable income is calculated by limiting companies’ ability to reduce taxable income below the numbers they show to investors. On net, this will be a drag on cash flow for C-Corps, i.e., the stock market, by undercutting their ability to pay dividends, to make investments, and to buy back their own stock.

The top personal tax rate on ordinary income is the single most important tax rate for the capital markets because it is applied to the income that flows through S-Corps, LLCs, sole proprietorships and other pass-through vehicles. The Biden plan raises the top marginal tax rate from from 37% to 39.6%. But it also removes the cap on income subject to the social security tax, which would add another 6.2%, making the effective top rate 45.8% for high earners, reducing after-tax income by 14% on the margin.

As an aside, don’t forget to add state income taxes. If you live in California, the top marginal tax rate is currently 13.3%, which would make the overall total top marginal rate 59.1%. I say currently because there is a bill in the legislature that would bump the California number to 16.8%, or 62.6% overall. The Biden plan, however, would allow taxpayers to deduct state taxes from taxable income again, much to the relief of Californians, New Yorkers, and others in high tax states.

But wait, there’s more, as they say on late night infomercials. The Biden Plan also doubles the tax rate on long-term capital gains from 20% to the 39.6% tax rate on ordinary income, raises effective tax rates on pass-through entities, and taxes carried interest at ordinary income rates. Oh, and it dramatically lowers the exemption threshold for the estate tax, and would likely increase the rate, but the details are not yet clear.

Analyzing the impact of these tax rate changes on asset prices is an interesting but complicated assignment. Since all of the tax rates on investment income seem to be going up, it is pretty clear that the average after-tax return on total assets will fall, which is not good for the overall market or investor net worth. Each change in a tax rate, however, will lower the after-tax return on some collection of assets in an investor’s portfolio relative to other assets. That will lead investors to rebalance their portfolios to reflect the new relative yields, driving their prices apart and their returns together.

Companies and sectors will be impacted differently based on the source of their profits, the channels they use–dividends, share buybacks, or reinvested capital to grow future profits–to distribute those profits to shareholders, and the tax position of their shareholders. I will post a detailed analysis of the impact of the Biden tax plan on the prices of all 10 stock market sectors in the next week.

JR