Summary: This thing is huge. But that’s not why it matters.

In case both your TV and Smart Phone are broken, yesterday the Saudi government (finally) announced that they will list Aramco on the public markets–first in Saudi, then abroad–in the coming weeks. Journalists are running out of of superlatives to describe its hugely huge hugeness. But they are leaving out the most important part. Whether Aramco’s market cap is $1.5 trillion, $2 trillion, or $2.5 trillion is a rounding error that makes no difference to anybody. What really matters is that the IPO is going to have a stabilizing impact on oil prices. That will make a difference for everyone.

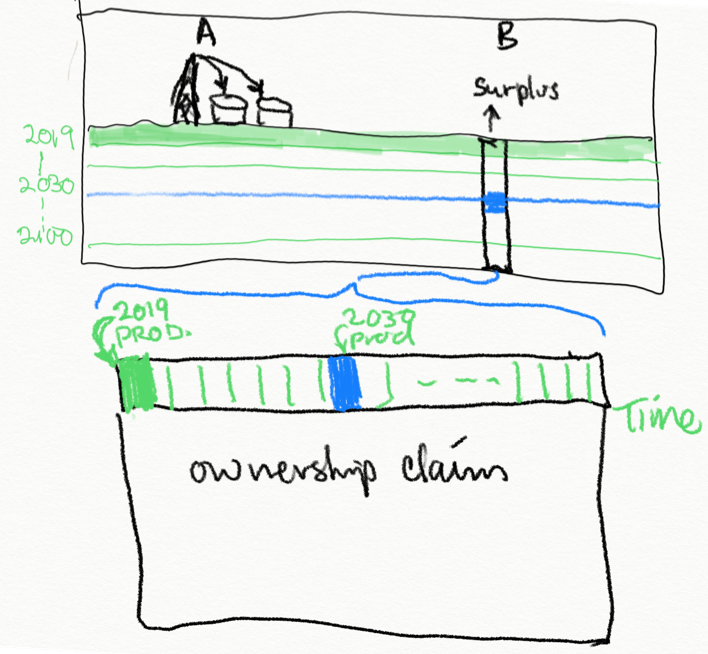

I will explain my price stability point using the graphic below that I first drew on a flip chart at the Kuwait fund 40 years ago to explain why spot oil prices were so volatile. I have been waiting to haul out this drawing since I had black hair and a lot more of it.

The graphic represents a side view of Saudi Arabia, or Kuwait, or any other oil-producing region in the world. There is sky, sand, and a jagnormous pool of oil under the ground–enough to last for 100 years at current production levels, conveniently located near a body of water deep enough to park a huge oil tanker.

You produce oil by poking a hole in the ground. When the oil squirts out (it is a gas-pressurized field), you store it in small steel tanks. When the oil tanker gets there, you open the valve to let the oil run downhill through a pipe where it loads itself into the belly of the ship. Then you sail the ship to Rotterdam, where you pump it into some more small metal tanks and sell it for a boatload of money. Tada! (My friends in the oil business tell me it’s a lot harder than that but you get the picture: jagnormous pool of oil, big (but not jagnormous) ship, little steel tanks.)

So what about the price? As long as oil production is roughly equal to the amount people burn driving their cars, heating their homes, and running their factories, the price won’t move around much. But every once in awhile one of the oil producers develops an intense need for cash to finance a budget deficit. To get the cash, they produce oil faster, which means more ships arriving in Rotterdam. But there is a problem–the tanks are already full and there is no place to put it so spot prices have to fall a lot to convince people to burn more oil by taking longer vacations, turning up their thermostats, and running their factories faster so there is room in the metal tanks for the new oil.

Volatile oil prices are the result of a storage problem. There are just not enough places to store it above ground. But wait–the oil was already stored at the beginning of our story; it was just stored under the sand. So why can’t we use that storage space to solve the problem?

Think of the jagnormous 100-year oil reserve in the graphic as a series of 100 horizontal layers of oil. Or, if you prefer, think of it as a wine cellar with the oldest vintages (the oldest dinosaurs) stored at the bottom of the cellar. In year 1–2019 in the graphic–the producer pumps out just the top layer, in year 2 they pump the second layer, in year 21 they pump the 39th layer, and so on, until they have emptied the jagnormous underground oil storage facility in year 100.

The way to keep oil prices stable is to mine the oil vertically, rather than horizontally by selling oil and oil storage services together, as a package deal. When a government needs money in 2019, they can simply sell future oil production–say, 2039 oil–by selling a claim on the 39th layer of the jagnormous oil reserve rather than pumping it out of the ground. The producer can sell all the oil they want and the buyer can buy as much or as little oil as they want without disturbing the spot price, which is determined by the amount of oil in the metal tank and the amount of oil that we burn to run today’s economy.

You can see that in the bottom graphic by turning the oil reserve on its side and viewing each year’s production as a dated coupon on a bond. The coupon can be traded so may be owned by different people over time, but ultimately it will be clipped and turned into actual oil production in the year written on each coupon. Since the promise to exchange the coupon for oil is made by the producing government, it is, in a true sense, a government bond. It is an indexed bond–like TIPS sold by the US Treasury but it uses oil prices in place of the CPI. The problem, of course, is that no foreign person would buy the coupons because they have no reliable way to enforce the property right over the claim. So the way to stabilize oil prices, I argued long ago, is to develop secure and enforceable property rights and transparent capital markets in oil-producing countries.

Capital markets in oil producing countries did not fit that description in 1979. But they do now as evidenced by the reception of the Aramco IPO by the investment community. The big news is not that a government would want to sell coupons secured by their oil reserves, it is that foreign investors are now comfortable enough to buy them.

The Aramco IPO is important because it represents a sea change in foreign investor trust in the Saudi capital market. Indeed, it is noteworthy that in the government announcement they spelled out an unusual level of detail about future tax rates, future royalty schedules at different oil prices, and future dividends, all of which will significantly support the value of the security. As they live up to each of those commitments over time, investor trust should increase further still, resulting in capital gains on the security, which is positive for both the investor and the Saudi government.

In the future, when the Saudi government has need for more cash than generated by the value of planned oil production, they will no longer need to produce and sell more oil to balance their budget. Instead, they can simply sell or buy Aramco shares in the open market. This will allow them to manage production levels more efficiently and will result in more stable production levels, GDP levels, and oil prices for all of us.

And that is huge.

JR