Dr. John Rutledge

Chairman, Rutledge Capital LLC

Honorary Professor, Chinese Academy of Sciences

Abstract

Strong growth and rising energy needs are increasing Asia’s reliance on energy supplies from the troubled Middle East, making energy security an urgent issue. Existing policies, based on orthodox demand-based economics and an overly narrow concept of energy are unlikely to solve the problem. This paper presents a new framework for thinking about energy and economic growth based on the broad concept of energy used in the natural sciences. This framework views economic activity as transfers of both current solar energy and vintage solar energy, stored in the form of natural resources, human capital, physical capital, and technology, driven by the uncompromising laws of thermodynamics. It points toward unconventional solutions to the energy security problem including investing in communication networks, information technology, and education; agricultural research to increase the efficiency plant energy capture and improve the productivity of farm workers and, thereby, release manpower for the energy-efficient services sector; and legal, regulatory, and exchange rate policies to provide a stable environment to attract high tech capital from global investors.

Introduction

People around the world are demanding improved living standards—and they are getting them. Global growth this year is likely to exceed 5%, the highest rate in nearly a half-century. Developing Asia—the epicenter of the world’s economic growth explosion--will grow at nearly twice that rate, led by the spectacular reform-driven performances of China and India.

Advances in information technology and communications networks have driven recent increases in global growth through three primary channels. First, they have made it possible for all people on earth to view each other’s lives, in real time, for the first time in history. This has exposed the gaping income and wealth differentials across nations to public view, making people in low-income countries demand pro-growth policies from their governments to give them the opportunity to improve their lives.

Second, technology has made it easier, faster, and cheaper to move resources around the globe to take advantage of the price and return differentials that drive economic activity. Labor, capital, and technology now move at the speed of light through fiber-optics networks at practically no cost.

Third, rapidly developing capital markets since the early 1980’s have reduced the cost of moving capital and the minimum differential-return threshold for triggering its redeployment (1). Policy reforms, including the recent WTO-mandated opening of China’s capital markets, have made capital still easier to move. The result has been faster speeds of adjustment and higher economic growth.

The resulting massive re-deployment of resources has increased global growth, but has also created economic and political conflicts, both within and among nations. These conflicts are manifesting themselves as rising protectionist pressures around the world.(2)

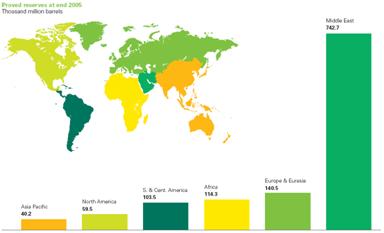

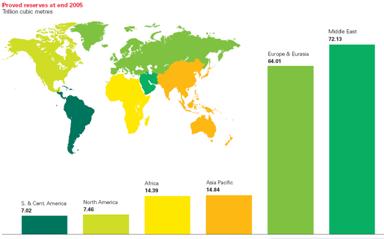

Rising economic activity has also increased Asia’s energy needs faster than can be provided by local supplies. This is increasing Asia’s reliance on locally available coal supplies, which has costly implications for air and water resources. And it is increasing Asia’s reliance on oil and gas imports from the troubled and potentially unstable Middle East, where the lion’s share of the world’s known oil and gas reserves is located.

Figure 1

Proved Oil Reserves at end 2005

(Davies, 2006, p. 3)

Figure 2

Proved Natural Gas Reserves at end 2005

(Davies, 2006, p. 18)

Without secure future energy supplies a nation cannot provide its people with the stable political and economic environment that underpins strong and sustainable economic growth. This is especially important for Asian nations, where the imbalance between scarce energy resources, large populations, and growing incomes is greater than in other areas.

For emerging economy governments, whose people have tasted rising incomes, halting growth is not an option. Energy security—securing long-term access to the energy resources that Asian nations need to provide sustainable long-term growth and rising living standards for their people--has become an urgent matter for Asian governments.

Some governments are taking steps to attack the energy security problem by increasing exploration for new resources, investing in resources outside their borders, undertaking long-term supply contracts, expanding use of nuclear power, investing in alternative fuel technologies and encouraging conservation.(3) Yet, in spite of great efforts and some successes, the ADB’s Asian Development Outlook (4) forecasts rising Asian oil and gas imports in the years ahead. The energy security problem grows larger every year. Access to energy resources is the most likely cause of future conflict among nations. Clearly, we need new thinking to solve this problem.

This paper presents a new framework for thinking about the relationship between energy and growth based on the broad concept of energy in the physical sciences and on the laws of thermodynamics that describe the energy transfers that drive all activity on earth.(5) In this framework, entrepreneurs respond to gradients (price and return differences) by employing both current solar energy and stored solar energy, in the form of natural resources, human capital, physical capital, and technology, to create work, which we refer to as economic activity. Resource flows between nations are driven by price and return gradients according to the second law of thermodynamics. Policies impact resource flows by impacting price and return gradients, providing incentives, or signals, for entrepreneurs to change their behavior.

This framework allows us to draw on recent important developments in non-equilibrium thermodynamics (NET)(6) developed by Ilya Prigogine and others that can help us understand the dynamic behavior of systems, including economic systems, over time. NET sheds valuable light on questions of recession, market failure, price bubbles, and stability.

This broader view of energy points toward unconventional structural solutions to the energy security problem including 1) investing in communication networks, information technology, and education; 2) investing in agricultural research to increase the efficiency of plants solar energy capture and to improve the productivity of farm workers to release manpower to the energy-efficient and environmentally-friendly services sector; and 3) legal, regulatory, and exchange rate policies to provide the stable economic and capital market environment needed to attract the vast amounts of high tech capital and technology that Asian economies need to transform their economies.

>>>NEXT PAGE>>>

---------------------------

(1) See Atkins (1991), pp. 104-105. It is almost always true that the rate of a chemical reaction increases with rising temperature. This rule describing what is now known as Aarhenius Behavior—first proposed by the Dutch Chemist Jacobus van’t Hoff (1884) and interpreted by Svante Aarhenius in1989—states that reaction rate is an exponential function of temperature, or Rate = e-Ta/T. In this expression, Ta represents the reaction-specific activation temperature—the threshold below which no reaction will occur. Ludwig Boltzmann derived an expression for the proportion of collisions between molecules in a reaction that occur with at least the activation level of energy Ea (the threshold below which no reaction will occur) as e- Ea/kT, where k, known as Boltzmann’s constant, is a fundamental constant of nature. As we will see below, the economic interpretation of Ea is the minimum price difference, in microeconomics, or return on capital difference, in capital markets, required to trigger a profitable arbitrage transaction, akin to the gold points during the time of the gold standard. Ea represents the friction, or transactions costs of engaging in markets. Reducing Ea increases adjustment speed.

(2) There are many examples in all regions. Recent examples in the U.S. include the aborted attempt of China’s CNOOC to acquire Unocal and the failed Dubai Ports deal—both killed by political backlash in the U.S. Congress—the recent action against the Chinese paper industry by the U.S. Commerce Department, and the Schumer-Graham legislation now under discussion in Congress.

(3) For a review of recent writings in NET see Schneider and Sagan (2005) and Prigogine (1997).

(4) “According to convention, there is fire, there is water, there is air, and there is earth. There is a sweet and a bitter, and a hot and a cold. According to convention there is inherent order in the universe. In truth, there is only atoms and a void.“ (Democritus, 400 B.C. , quoted in Discovering Enzymes, David Dressler and Huntington Potter, 1991.

|