Arbitrage Drives the global Economy

For historical reasons, stores of energy are not evenly distributed around the globe. Oil and gas are concentrated in the Gulf Region, with significant deposits in Russia, Africa, South America, and Australia. Technology and physical capital are concentrated in North America, Western Europe, and Japan. Human capital is concentrated in Asia.

Figure 8

Global Energy Stores

If national economies are closed, with no trade, then national endowments of stored energy will determine prices, which will vary from nation to nation. This is illustrated in Chart 9 below by the two compartments of a washtub, separated by a solid barrier. International trade textbooks refer to this as a state of autarky.

Figure 9

Closed Systems

When two formerly closed systems are brought into contact to form a new, single, open system, the second law of thermodynamics forces energy to disperse. In the washtub example, in figure 10, the pressure differential caused by different water levels in the two tanks forces the water to flow from the full tank to the empty one. This adjustment also works for temperature adjustments, between high and low pressure systems in meteorology, and in chemical reactions. All are, formally, cooling processes in which a new open system moves toward a low energy state. In economics, this situation describes arbitrage behavior, where entrepreneurs redeploy resources in response to price or return differentials.

Figure 10

Open Systems (Arbitrage)

In the absence of continuing energy flows, the end result energy flow will be thermal equilibrium, illustrated in Figure 11, in which no further energy flow takes place. This is also known as the zeroth law of thermodynamics. In economics, a market is defined as an area in which prices will tend to converge to a single level; this is also known as the law of one price. The law of one price in economics corresponds to thermal equilibrium in thermodynamics. It is the point at which no further arbitrage will take place.

Figure 11

Thermodynamic Equilibrium

In the global economy, stored energy imbalances lead to price and return differentials that trigger arbitrage activities in which entrepreneurs redeploy resources toward areas of greater relative scarcity. This can be viewed in two equivalent ways.

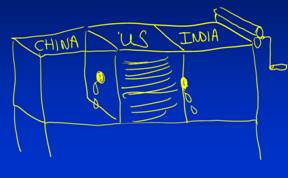

From the point of view of the owner of physical capital, shown in Chart 12, the U.S. is abundantly supplied, while capital in China and India is relatively scarce. Returns on capital will be lower in the U.S. than in China and India. The relative price of capital goods will be higher in China and India than the U.S. Opening trade, and creating a single open market, will create incentives for owners of capital to redeploy their resources out of the U.S. and into China and India. This will take place as a combination of Foreign Direct Investment (FDI) and Portfolio Investment. This redeployment redresses the imbalance, forcing returns closer together (10).

Figure 12

Arbitrage – Physical Capital

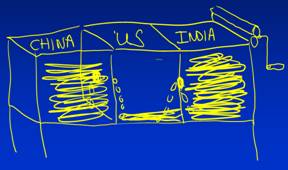

From the point of view of the owners of human capital, the situation is depicted in Chart 13, below. Human capital is abundant in China and India relative to the U.S., which makes wages and incomes lower in Asia than the U.S. Linking the three nations in a global economy will result in a net flow of human capital from Asia to the U.S., which will raise wages in China and India and lower wages in the U.S.

Figure 13

Arbitrage – Human Capital

The influx of human capital in the U.S. will take the form of immigration, outsourcing, and imports of goods and services, which embody human capital in their values.

>>>>NEXT PAGE >>>>

---------------

(10) American investors will not see this because financial statements of U.S. public companies report the profits and returns of companies listed in America, not for capital deployed in America. This is one of the major reasons why U.S. companies have been reporting record profits as a percentage of GDP for some time.

|